pud99

Senior Member

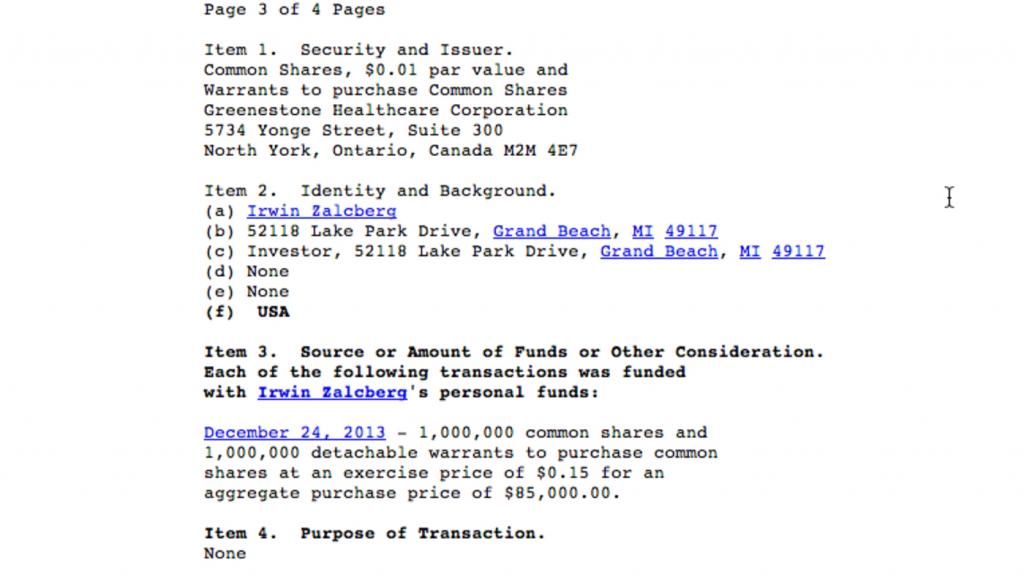

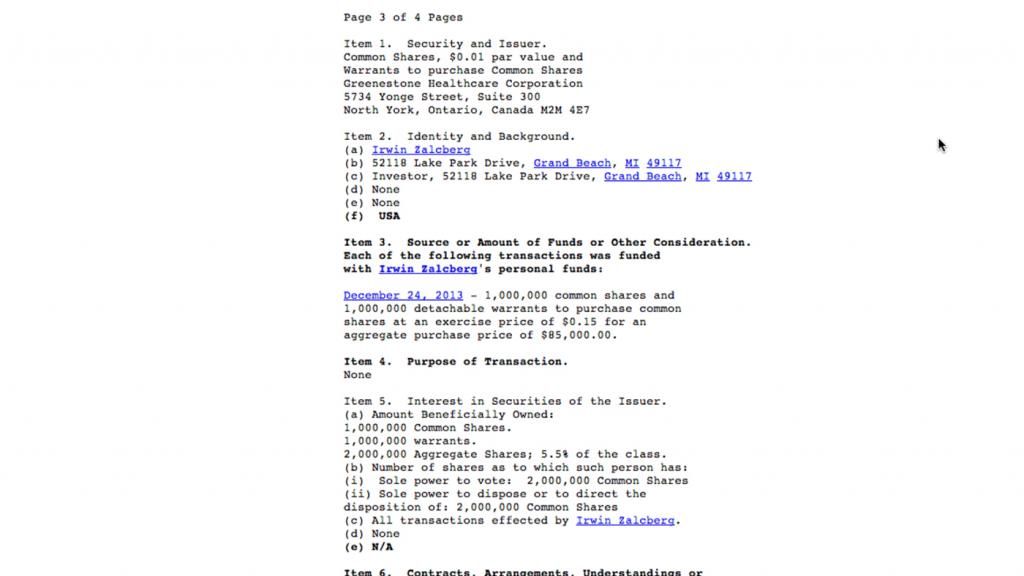

Giant investor in medical marijuana invested heavily in Greenestone January 2014. Lives in Chicago.

http://www.sec.gov/Archives/edgar/data/792935/000143359114000001/0001433591-14-000001.txt

http://online.wsj.com/article/PR-CO-20140320-906205.html

http://www.yellowpagesgoesgreen.org/whitepages/details/il/IRWIN_L_ZALCBERG/9033364

This is just someone fiddling around with some of their "milk money" - taking a flier on a penny stock (GreeneStone) that trades (if ever) OTC.*

*Over the counter - i.e., it is not listed on a stock exchange.