sublime

Active Member

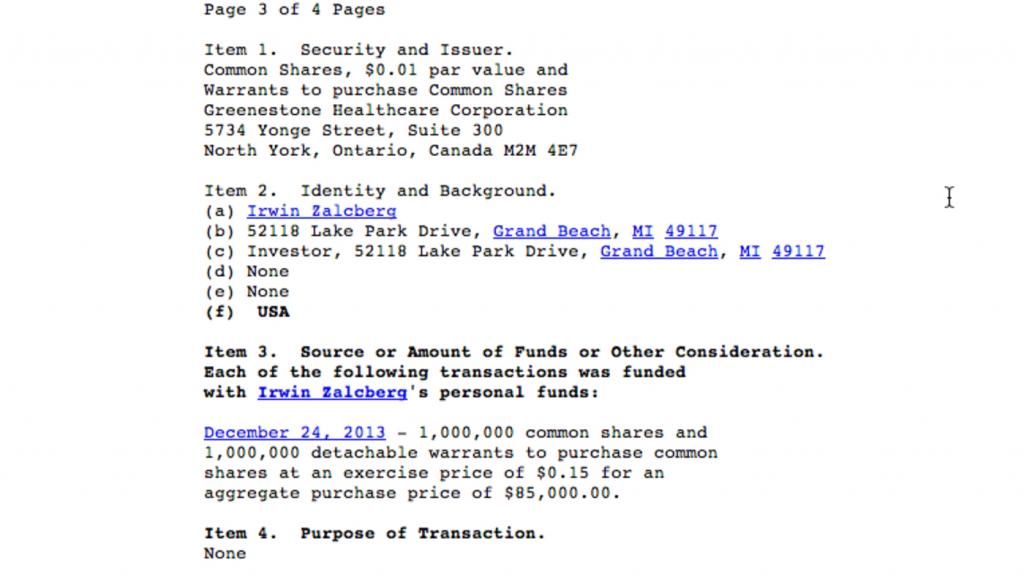

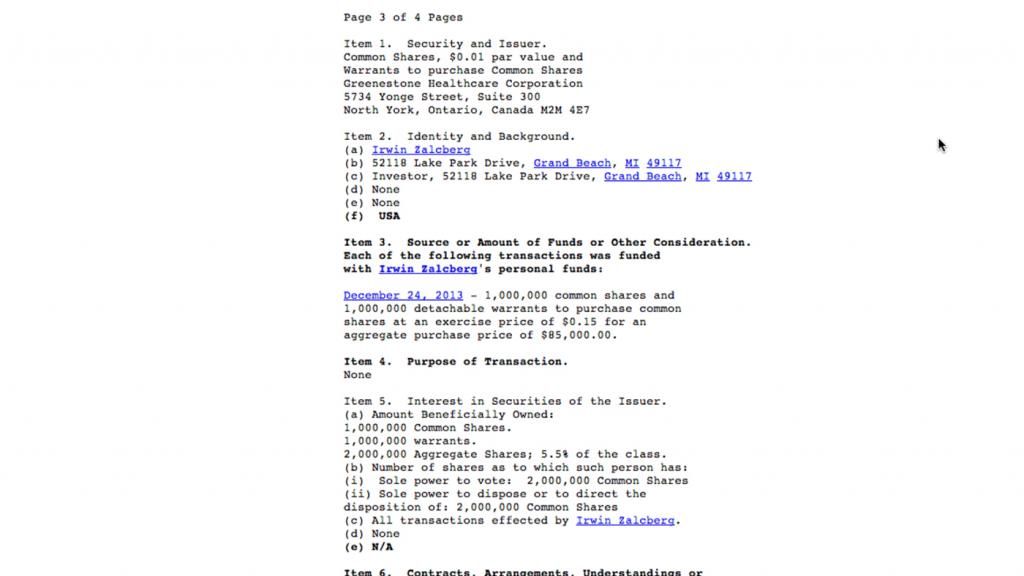

does anyone know who greenestone's unknown buyer is?

Not I.

GRST has announced two letters of intent for agreements that could have an enormous but challenging to quantify potential impact on the Company’s valuation. These letters of intent – the potential addiction treatment merger and the potential sale of property by CEO Shawn Leon to GRST, may result in:

-An infusion to GRST of up to $7.75 million in cash and equity

-Ownership of an undisclosed percentage in a merged entity with an unknown total valuation

-Acquisition of a $9 million real estate asset

-The issuance of perhaps 50 million shares to fund the acquisition.

-The assumption of $4 million in debt associated with the land acquisition

-The possibility of access to additional debt financing to be secured by the land asset.

-An unknown impact on operating cash flow as GRST’s rent payments become debt service payments.

Because these agreements have not yet been completed and their terms have not been identified in detail, it is highly challenging to assess their potential impact. This is particularly true of the possible merger. With regard to the land acquisition, the Company’s potential valuation may increase by the $9 million land value cited by GRST, raising the possible total to $43 million, but it is assumed that this would increase the total potential share county by perhaps 50 million shares to a total of approximately 101 million shares, or a value closer to $0.43 per share.

Feb. 5th, 2014 murphyanalytics/GRST_Initiation.pdf

http://globenewswire.com/news-release/2014/05/08/634726/10080919/en/GreeneStone-Completes-First-Phase-of-Strategic-Financing.htmlThe Transaction involved the takeover of the Company's Toronto outpatient treatment office by the purchaser. The full details of the Transaction will be disclosed in the soon to be released first quarter 10Q filing.

http://www.secinfo.com/dmZqr.nDk.htm#1stPage

Last edited: