Following quickly on the heels of the big news that Google-affiliated Sidewalk Labs will be designing Toronto's Quayside neighbourhood in partnership with Waterfront Toronto, attention has shifted to the Amazon Second Headquarters (HQ2) bid as cities across the continent submit their competing entries prior to today's deadline.

Governments in the Greater Toronto Area are actively involved in the courtship of Amazon for the $5 Billion development. Spelling out the GTA bid is an almost 200-page document prepared by Toronto Global—an arms-length organization representing the region's municipalities—outlines for all what many of us already know about the region's diversity, demographics, and political climate, while also exploring the various existing and future leasing opportunities available to Amazon in several centres across the GTA.

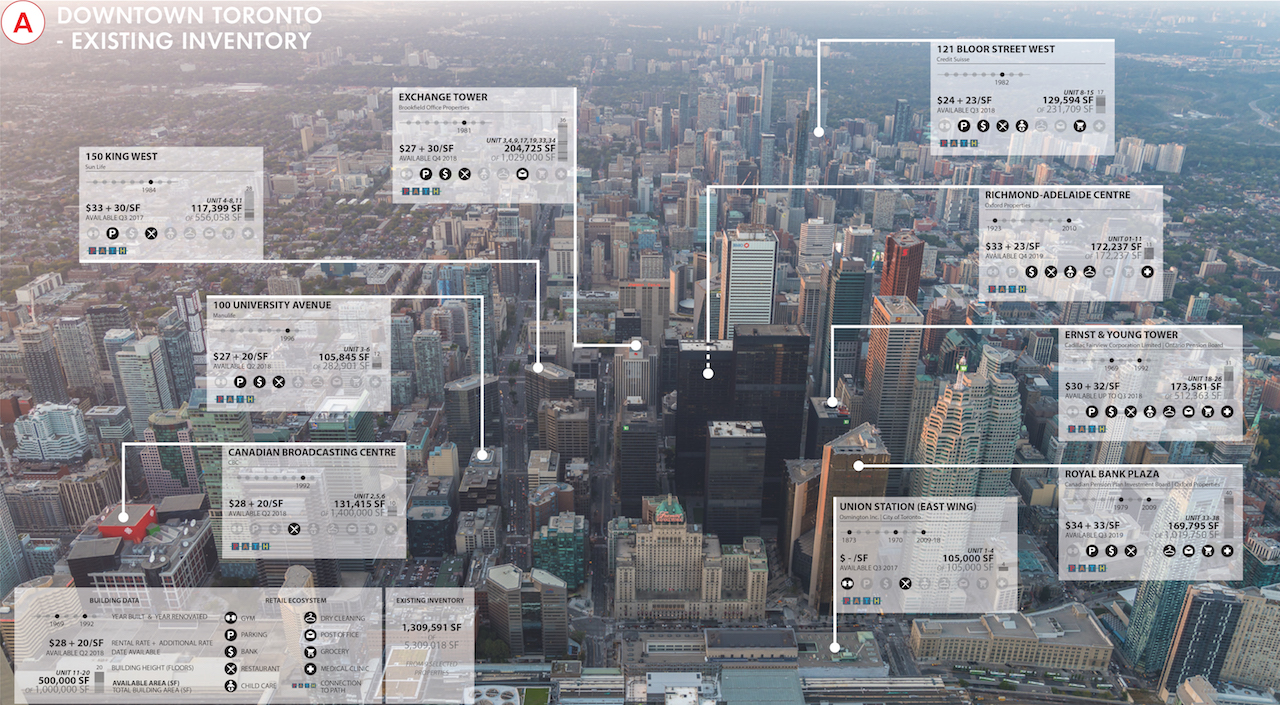

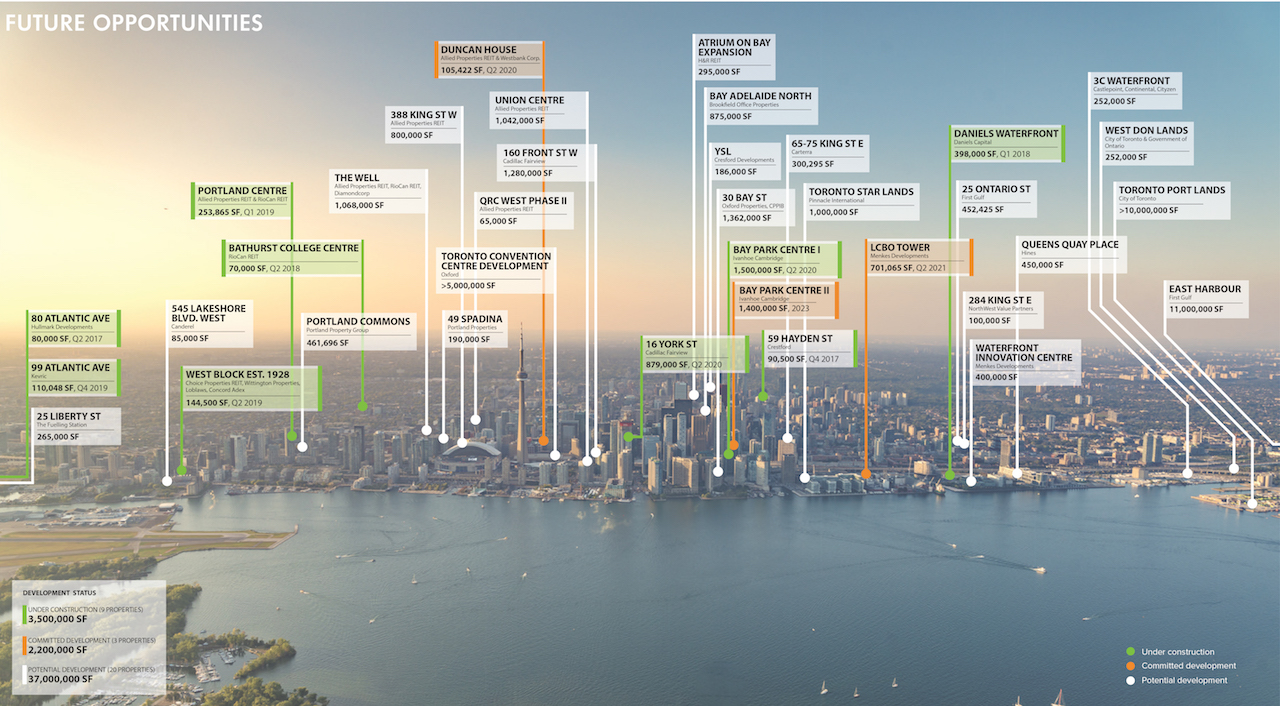

In amongst the many graphs and illustrations in the report are two infographics focused on Downtown Toronto, the only area we are looking at in this article. The first outlines the many existing buildings within the Financial District with significant current or upcoming vacancies, the second looks at upcoming development.

The first infographic lays out over 1.3 million ft² of combined space spread across 9 existing properties, the largest vacancy of the bunch available at the Exchange Tower, where 204,725 ft²—roughly one fifth of the building’s total gross floor area—will become available during the 4th quarter of 2018. This diagram also covers the price per square foot lease rates, as well as the various amenities found in the vicinity of each property.

Existing leasing opportunities within the Financial District, image via Toronto Global

Existing leasing opportunities within the Financial District, image via Toronto Global

The next page in the bid document titled Future Opportunities covers the nearly countless developments that could be available to Amazon should they choose to locate in Toronto. The graphic groups projects into three categories;

- under construction developments,

- committed developments, and

- potential developments.

In the under construction category, the first development to be highlighted is 1.3 million ft² tower 1 of CIBC Square (listed below under the working title of Bay Park Centre 1), but broken out on a following page with its up-to-date name. Curiously, the document (which makes some factual errors regarding the tower as being a retrofit of an existing building) does not make plain that CIBC is the lead (and possibly only) tenant here. Nevertheless, this building represents the largest of those currently under construction, coming online in the second quarter of 2020. Also set to come online in Q2 2020, is the 879,000 ft² 16 York Street. Second largest of the office properties currently under construction, it is noted to be underway without any pre-leasing.

Of the committed developments category, again, CIBC Square's second tower of 1.4 million ft² of space is largest, projected to be complete some time in 2023. The next largest developments would be the LCBO Tower and 19 Duncan Street, which would respectively offer 701,065 ft² and 105,422 ft², coming online in Q2 2021 and Q2 2020. The majority of space in all three of those buildings is spoken for.

Future leasing opportunities in Toronto, image via Toronto Global

Future leasing opportunities in Toronto, image via Toronto Global

Larger opportunities exist down the road in the potential developments category, which identifies 37,000,000 ft² of office space which could be built in Toronto from plans floated in recent years. 11 million of that is planned for the massive East Harbour project, 10 million ft² for the upcoming Port Lands redevelopment, and 5 million ft² within a potential redevelopment of the Toronto International Convention Centre. Other office towers highlighted on the infographic include Union Centre at 1.04 million ft², 160 Front West at 1.28 million ft², and 1.06 million ft² at The Well. This could be considered another mistake in the bid book, as that building can be considered at minimum a committed development, but should more likely be included in the urban construction category as site prep work is underway at the site now. Many more buildings under a million ft² also make up the sites identified on the infographic.

With dozen of cities in the running, there are plenty of factors at play that will determine whether or not Toronto wins the bid for Amazon's HQ2. We will be sure to return with updates as more information becomes available. In the meantime, you can learn more about the various projects highlight in the infographics above by visiting their UrbanToronto database files, linked below.

4.7K

4.7K