kamira51

Active Member

Our country is an absolute joke.Classic. Tell NATO we'll meet 2%. Order DND to cut $1B from the budget.

Our country is an absolute joke.Classic. Tell NATO we'll meet 2%. Order DND to cut $1B from the budget.

Despite a desperate need for new housing, Canada's developers are building fewer homes than they were at the height of pandemic lockdowns, a new study says – and experts say that could mean a generation of Canadians won't be able to afford homes for most of their adult lives.

Inflation and the Bank of Canada's response to it, has been the main reason for the slowdown, according to David Macdonald, a senior economist with the Canadian Centre for Policy Alternatives (CCPA).

The new decline in housing development started last year, when the Bank of Canada started to raise interest rates to cool the economy and combat inflation, Macdonald found in a new report for CCPA.

Compared to April 2020, when lockdowns shut down part of the development industry, investment in new single-family homes is down 21 per cent, the report says. New apartment construction is down two per cent from that time and row house development is down eight per cent.

"The impact of Bank of Canada rate hikes have been breathtaking," Macdonald wrote in his report.

They're also unsurprising, he says.

"If you have to take out a loan to engage in a type of economic activity, higher interest rates matter," Macdonald wrote.

"This means that higher interest rates increase carrying costs for businesses looking to build things like residential housing or consumers looking to buy those houses."

Some developers wary to invest

In the CCPA report, Macdonald says interest rates will only continue deterring private development.

The problem: from planning to approval to construction, housing developments can take five to 10 years before they're ready for residents to move-in.

With interest rates uncertain and costs changing quickly, projects are becoming riskier, some developers say.

"Many people in industry are…more cautious," Sherry Larjani, president of Spotlight Development in Toronto, told CBC Toronto.

Larjani says high interest rates have also made it harder to find buyers, as extra costs are passed on and mortgage rates become less affordable and harder to predict. She says she's seeing some developers cancel projects as a result.

Lengthy approvals processes are also making things difficult, Larjani says.

"It's not only that the construction cost goes up, it's not only that the rates are up, it's not only that people can't afford their daily food and shelter – it is the fact that the government has not figured out how to streamline the process (to approve developments)."

Several Liberal sources said Coun. Josh Matlow is considering a run for the Liberal nomination in the riding, which includes the ward he represents on Toronto City Council.

www.ipolitics.ca

www.ipolitics.ca

A familiar face could be eyeing the federal Liberal nomination in Toronto-St. Paul's. Current MP Carolyn Bennett will not run for re-election.

Coun. Matlow 'thoughtfully considering' next steps amid rumours he'll run for Liberal nomination in Toronto-St. Paul's - iPolitics

"I have heard from many of my neighbours and fellow community members who have encouraged me to seek the federal Liberal nomination, and I am actively and thoughtfully considering how to best continue my work representing Toronto-St. Paul’s," Matlow said in a statement.www.ipolitics.ca

I am not sure how well he will do.

Federal Politics is alot different from grassroots local politics. He is great as a councilor but I am not sure how well he would do with bigger issues like defense, foreign aid, etc as opposed to local issues that matter.

That's easy. Do and say exactly what the party staffers (and/or PMO is you get lucky and draw to the winning side) says; no more, no less.I am not sure how well he would do with bigger issues like defense, foreign aid, etc as opposed to local issues that matter.

Paywall free: https://archive.ph/e5s3W

The problem for the LPC is succession. Freeland is competent, but not a Quebecer. Joly is a Quebecer but weak. Anand can likely hold her Oakville seat, but none of these three as LPC leader are going to beat the Cons in seat-rich Ontario. Who else is there as a potential Trudeau successor?

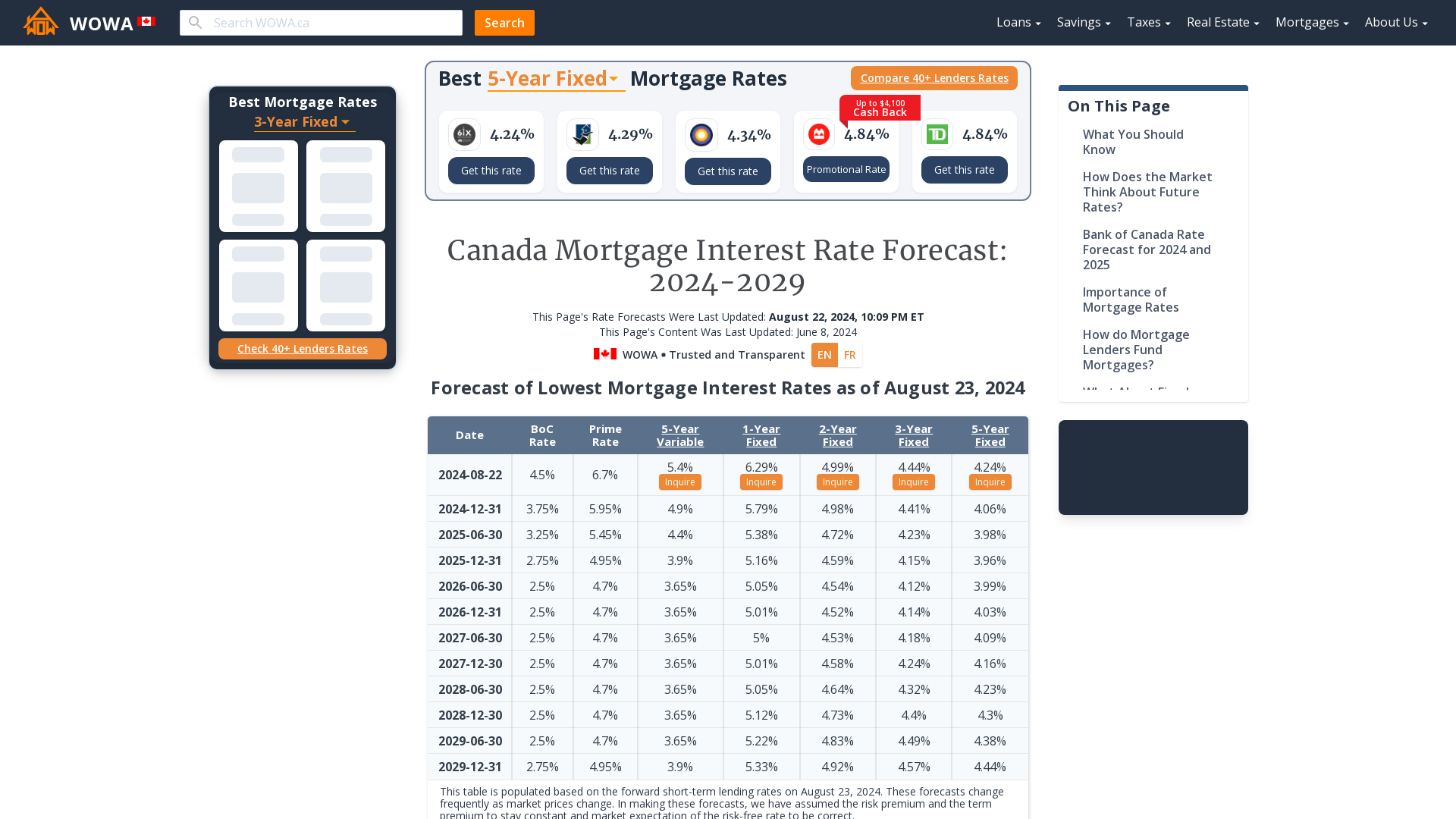

The Bank of Canada, raising interest rates, is the main reason for the Liberals decline in support. People are pissed off they have to pay

thousands more for their mortgages, and they are blaming the Liberals whether that is right/wrong.

Add the fact that, interest rates hikes are making the housing crisis worst, and hurting first time home buyers.

The Bank of Canada, raising interest rates, is the main reason for the Liberals decline in support. People are pissed off they have to pay

thousands more for their mortgages, and they are blaming the Liberals whether that is right/wrong.

Add the fact that, interest rates hikes are making the housing crisis worst, and hurting first time home buyers.

I remember as a kid having a GIC that paid out close to 20%. That's one of the issues today, we have high borrowing rates, but the banks are not giving equally high saving rates.You may be on to something.

The highest interest rates ever recorded in Canada was in August 1981 when they reached 22%. Coincidentally, it was Pierre Trudeau who was in office at the time and the coming election in 1984 saw the Liberals lose to the PC Party.

I remember as a kid having a GIC that paid out close to 20%. That's one of the issues today, we have high borrowing rates, but the banks are not giving equally high saving rates.

We're not going to see 20% mortgage rates. A five year variable rate today is 6.05%, and rates are expected to start coming down in 2024.At 20% we are looking at around $15000 a month for mortgage payments on a million dollar home. Watch how much supply comes onto the market and how quickly prices tank.