@Urban Sky Any news on the Mount Royal tunnel sharing between HFR and the REM? News I hear from my part, it's not even being considered into engineering plans.

I unfortunately can't say anything about anything specific to this case, therefore, I will try to think how a generic investor would act: provided with a clear mandate about developing a transit project, but without any guidelines or limits to that mandate, I would probably also just take what I find useful and not spend any consideration of what alternative uses might be in the public interest now or later. As a pension fund, I'm solely accountable to my individual or institutional investors who have trusted me their money and voluntarily foregoing revenue by making provisions for transportation networks which will be outside of my responsibility would difficult to justify to them, especially if it causes delays to be the planning stage, thus delaying construction and thus the positive cashflows which generate the return of my own investors. Preserving the public interest is solely the responsibility of the governments, its institutions and the general public and if they don't force me to ensure interoperability, why would I care nor why should I care? Because that's why governments always retain the responsibility for conceptualizing and planning of vital pieces of transportation infrastructure and maintain control in key aspects of its operation to preserve the public interest - well, that's what I thought until 4 years ago...

This is probably still more than I should have said, but I don't anticipate that any thinkable outcome would affect HFR negatively west of Montreal - and if east of Montreal was crucial to the business case of HFR, it would have most probably been included in the initial scope of the project...

I also don't see how VIA is able to compete with the bus companies on price while being profitable given that their current per passenger subsidy is equivalent to the starting fares on the busses

here (page 11). Ultimately, I see VIA going after expense accounts with good service being the driver of its future ridership. Meanwhile, those on a budget will be relegated to grabbing a ride with friends or the dreaded bus.

If you take the average implied cost per passenger and multiply it by the load factor from my analysis below, the breakeven is $68.60 per passenger on the Montreal to Quebec City route assuming a 100% load factor (which is not feasible on a train). Given that there is almost no route to profitability for VIA as shown in my analysis below, the only justifications for funding VIA are political and social. For this, I ask you to refer to the bottom half of my analysis below.

If you do the math, the revenue generated by VIA from business class in the Montreal to Quebec City corridor is roughly equivalent to economy class once you account for the differences in seat density and differences in service. Yet the decreased seat density in business inhibits the ability for VIA to maximize the total passenger capacity of its corridor fleet. I'll edit this post once I have time to clean up my charts.

View attachment 245722

[...]

As seen in the chart VIA's unadjusted average business fare barely covers the blended implied cost per passenger, with economy fares falling far below it.

[...]

From a political perspective, the optics today of middle/upper-class people riding "fancy" trains with a per passenger subsidy that is roughly equivalent to a lower-class person's Greyhound/Megabus fare doesn't look good. I'm concerned that an exacerbation of this through a focus on business travellers could be one day politically wielded to disband VIA's corridor services given that busses are a vastly more cost-effective method of public transportation. I hope I'm wrong, but the numbers I see don't add up.

According to page 11 of

VIA's 2018 Annual Report, all train services operate at a loss and require government subsidies to fund the shortfall.

The problem with your analysis is that the financial figures you take the "fully allocated" costs and revenues from the Annual Report rather than the "direct" costs and revenues from the Corporate Plan 2019-2023 Summary. As I've explained in more detail in Post

#6,745, fully allocated costs are only appropriate when looking at a network as static ("How much subsidy does the network require and how does it distribute across the network?"), whereas direct costs represent the share of the railroad's total costs which are actually associated with the operations of a particular route (and thus change somewhat proportionally if that service is expanded or reduced). As the Quarterly Reports for Q1 and Q2 will certainly show this year, VIA's so-called "operating costs" are largely insensitive to a change in the amount of trains actually operated, as most of its costs are not associated with the operation of any specific train (or of any train at all).

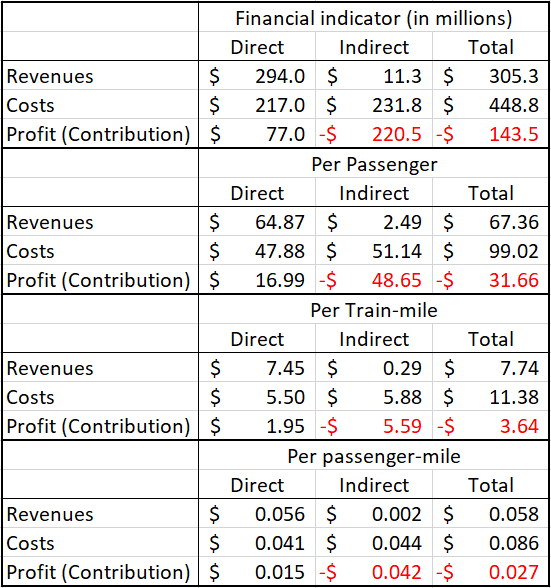

For the purposes of inter-carrier competition (e.g. Megabus-VIA or RMR-VIA), the relevant question is whether the operation of a certain service increases or decreases VIA's overall subsidy need. And that question is answered by the direct cost and revenue figures published in the Corporate Plan, as only 48.4% of the operating costs reported for the Corridor reported in the Annual Report are actually related to the operation of the Corridor services, whereas the majority of that figure (51.6%) is simply VIA's overheads allocated to the Corridor, whereas almost all (96.3%) of the Corridor's operating revenues are indeed generated by these services. Therefore, once you acknowledge that the avoidable costs of operating VIA's Corridor services are $217.0 million (and not the $448.8 million reported as "operating costs" in VIA's Annual Report) and that its revenues are $294.0 million (so only slightly less than the $305.3 million reported in the Annual Report), the Corridor's subsidy of $143.5 million per year ($31.66 per passenger, $3.64 per train-mile and 2.7 cents per passenger-mile) turns into a profit of $77.0 million ($16.99 per passenger, $1.95 per train-mile and 1.5 cents per passenger-mile), of which $37.8 million is consumed by the direct deficits of the non-Corridor services (Canadian: $6.5 million, Ocean: $11.3 million and the Regional services: $20.0 million), while the balance of $39.2 million helps to lower the deficit resulting from VIA's non-direct costs (e.g. overheads like my very own salary), which is why this "profit" is also called "contribution"...:

Compiled from:

VIA Rail Corporate Plan 2019-2023 Summary (pp.20-21), with Passenger data provided in (or extracted from) the

Annual Report 2018 (p.9) and train-mileage data calculated in Post

#6,434.

For a break-down for the entire VIA network, please refer to the following table I posted in Post

#6,745:

To be frank, I think we'll be lucky if the Canadian restarts in November without some form of involvement by Rocky Mountaineer.

Rocky is always good for anti-VIA lobbying, but I don't see them making any potent argument: if you look in the table above, the Canadian recovered 90.1% of its direct costs in 2018 and even 101.2% in 2017. Let's ignore the 2017 figure, but if the Canadian manages to recover 90% of its direct costs over its entire route, over the entire year and over all passenger segments, then you can safely assume that its operation generate a healthy profit on the route segments (Jasper-Vancouver), seasons (April-October) and passenger segments (high-end tourism) where it competes directly with RMR, which means that rather than subsidizing a service to compete against RMR, the revenues generated by this service reduce VIA's overall subsidy need...