I've been house hunting outside of the city and there is a lack of for sale signs. I think downtown people are seeing the opportunity to make some money by selling. Although, where do you go?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Baby, we got a bubble!?

- Thread starter simuls

- Start date

typezed

Active Member

This was my point to some degree. Never believed that this just started happening. Hasn't the upward price growth in houses been occurring for a steady couple of decades? Could have used my uncle as an example. His is 71 and divorced, has a girlfriend of similar age, also divorced. They both own houses and go back and forth between each other's. They each have exes with houses. Again four adults, four houses. The death do us part generations are now 80 and 90, their houses being released over the last decade or two on to the market. I'm just wondering where this pent-up demand that will buttress any price retraction is coming from. The tail of the baby boom is about 53 now. It was reported yesterday that there are now more people over 65 in Canada than there are children. There should be a trend towards a large cohort of homeowners downsizing, moving into retirement homes, dying. The following generations haven't had the secure jobs and pensions, haven't started families in the same way. Is immigration making up all the difference, causing this perceived shortage in housing availability? Maybe in Toronto and Vancouver, but prices have climbed throughout the country. Or is there also a cultural component? Fewer people in more houses. More square feet for the individual. Amongst younger generations, do those who have well-paying jobs and good futures, both male and female, expect to own the family homes of their childhoods as a sign of their adult success, even as they live with serial monogamy, and wonder if they'll ever bother with the families?I don't see this relationships scenario as being much different than the situation in the 90s.

We're not talking about 1950s.

Ex-Montreal Girl

Active Member

I am guessing downsizers are grabbing the money and running while they can.

Where do they go? Beats me. I can't imagine selling a Playter Estate house and moving into an 800 sf condo. But that's just me.

My recently-retired brother and his wife just listed their large 905 detached (kids are married and gone and own their own houses nearby) and bought a 1600 sf (above ground) bungalow in a small new development north of the tri-city area. A lot less land to worry about, a heated drive and walk (no shoveling), no stairs (although there is a soon-to-be-finished high basement), and very close to the town and hospital. I'm reading that all these once-small towns around the GTA are turning into bedroom or retirement communities. What my brother did fits the formula.

Where do they go? Beats me. I can't imagine selling a Playter Estate house and moving into an 800 sf condo. But that's just me.

My recently-retired brother and his wife just listed their large 905 detached (kids are married and gone and own their own houses nearby) and bought a 1600 sf (above ground) bungalow in a small new development north of the tri-city area. A lot less land to worry about, a heated drive and walk (no shoveling), no stairs (although there is a soon-to-be-finished high basement), and very close to the town and hospital. I'm reading that all these once-small towns around the GTA are turning into bedroom or retirement communities. What my brother did fits the formula.

ElDee

New Member

Also, as mentioned before, in my area, foreign speculators are pretty much a non-issue on the residential side. There are basically no foreign bidders in detached home sales in the area. I won't deny it's an issue in some areas (eg. Willowdale), but location is an important factor. I suspect that is why there is so much disagreement amongst real estate agents about the impact of foreign speculators, because each region is different. Ironically, on the commercial side, some of the malls are foreign owned. They bought up uber cheap strip malls back like 30 years ago and put very little money into them. They keep them presentable enough to lease out and then just sat on them. They get lease income to cover their expenses and then some, but also waited for rezoning from commercial to mixed-use residential/retail before selling. And now they are selling to condo developers for huge profits. Those are the foreign speculators in my area, but they have nothing to do with the traditional residential market.

This is a very interesting point, and is also something that I've had a gut feeling about myself for a while (based only on empirical observations.) The speculation/flipping or the 'owned-but-vacant house' phenomenon just doesn't exist in some 'hoods.

To use a particular neighbourhood that I'm very familiar with as an example, there's a small community off of Greenwood Avenue North of Gerrard that one enters through Torbrick Road. "Old Riverdale", it calls itself.

I've watched this neighbourhood go from being half decent with a few minor dents and cracks 15-20 years ago to becoming a fully decent place over the years. There are tastefully groomed front and back yards with shiny luxury cars popping up on drive ways. Many of the observable people coming in over the years tend to be young to early-middle aged families with adults heading to work dressed in such a way that implies white-collar professions.

I believe prices have been in the $700k-750k range in the past year or so. Back in the early 2000's, these were going for under $300k!

If one can overlook the fact that the houses are all semis, the area is fantastic for families with most of the houses having 3-4 bedrooms.

It seems to me that this area has been averse to speculation, flipping or squatting. For now, perhaps.

In comparison, going further up Greenwood to just north of Danforth where it used to be that the majority of houses were tiny detached bungalows on large lots - there appears to have been many full teardown/rebuilds (of the stucco variety, I might add.) Was there speculation/flipping activity here? My gut says 'yes.'

At the end of the day, I'm sure it is end-users who are buying and moving into these houses just as much as it is in Old Riverdale - just with an added presence of flippers in the past. However, I still wouldn't think that there are property squatters here. I have also not observed much "foreign speculator" presence here.

Then again, I'm not exactly patrolling the streets every day on the lookout for these things.

So what are the factors about certain areas that attract more speculators? In the Old Riverdale case, maybe it's the fact that price appreciation of semis are generally slower than fully detached homes, but there must be more to it, no?

Last edited:

Ex-Montreal Girl

Active Member

This is a very interesting point, and is also something that I've had a gut feeling about myself for a while (based only on empirical observations.) The speculation/flipping or the 'owned-but-vacant house' phenomenon just doesn't exist in some 'hoods.

To use a particular neighbourhood that I'm very familiar with as an example, there's a small community off of Greenwood Avenue North of Gerrard that one enters through Torbrick Road. "Old Riverdale", it calls itself.

I've watched this neighbourhood go from being half decent with a few minor dents and cracks 15-20 years ago to becoming a fully decent place over the years. There are tastefully groomed front and back yards with shiny luxury cars popping up on drive ways. Many of the observable people coming in over the years tend to be young to early-middle aged families with adults heading to work dressed in such a way that implies white-collar professions.

I believe prices have been in the $700k-750k range in the past year or so. Back in the early 2000's, these were going for under $300k!

If one can overlook the fact that the houses are all semis, the area is fantastic for families with most of the houses having 3-4 bedrooms.

You are correct about "old Riverdale" -- at least according to what I know. A girlfriend bought a semi just NW of Gerrard/Broadview in 2001 for just over $200K. On Bloomfield which, I am told, was a development built by CP for its managers back in the teens/20s. I don't know if that's true or not. Anyway, she finished the basement, adding a bedroom and bathroom, and reno'd the kitchen and sold for $850K in 2015. I know that three of her neighbours are still there because she remains friends with them.

algotr8der

New Member

Come to richmond hill and markham and you will see for dozens of for sale signs at every residential street intersection.

On weekends, all you see are open houses every other house.

What does this mean? Who knows, but I have never seen this in my life.

On weekends, all you see are open houses every other house.

What does this mean? Who knows, but I have never seen this in my life.

Eug

Senior Member

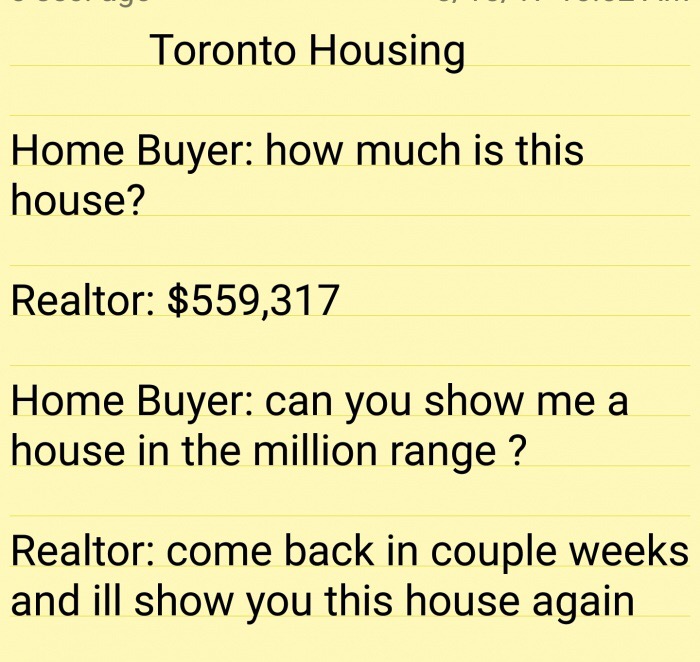

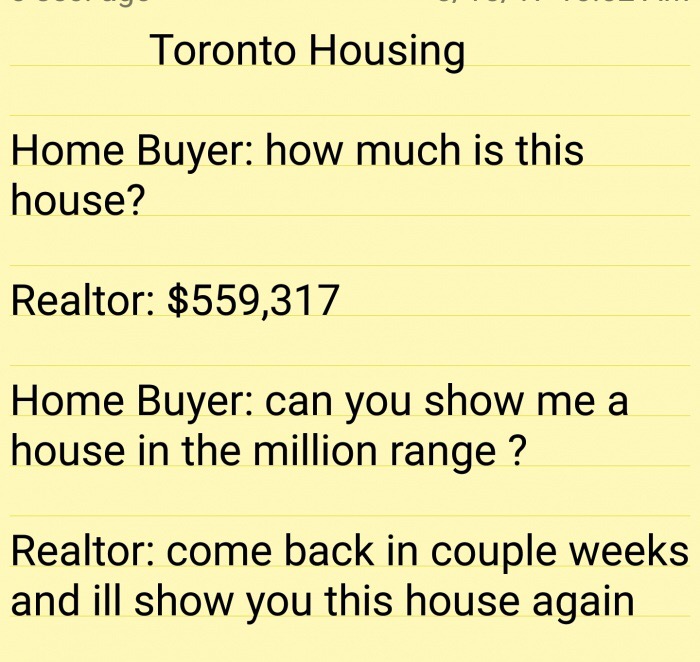

You know the Toronto real estate market is getting out of hand when www.EbaumsWorld.com which is a Millenial oriented joke, fail video, and meme site in the US, posts this as a joke:

BTW, the intensification initiatives in the outer 416 seem to be working. A Starbucks just opened up on Kingston Road near the heart of the old rundown motel strip.

BTW, the intensification initiatives in the outer 416 seem to be working. A Starbucks just opened up on Kingston Road near the heart of the old rundown motel strip.

christiesplits

Senior Member

I am guessing downsizers are grabbing the money and running while they can.

Where do they go? Beats me. I can't imagine selling a Playter Estate house and moving into an 800 sf condo. But that's just me.

My recently-retired brother and his wife just listed their large 905 detached (kids are married and gone and own their own houses nearby) and bought a 1600 sf (above ground) bungalow in a small new development north of the tri-city area. A lot less land to worry about, a heated drive and walk (no shoveling), no stairs (although there is a soon-to-be-finished high basement), and very close to the town and hospital. I'm reading that all these once-small towns around the GTA are turning into bedroom or retirement communities. What my brother did fits the formula.

Many boomers are cashing out, but they're not necessarily moving to condos. My parents are in their 60s around Pape and Danforth - a more common occurrence on their street is for the empty nesters to move out of town and pocket the windfall, maybe giving the money to their kids for a down payment. Recently two separate neighbours have moved to Palmerston, Ontario and coastal Nova Scotia.

Last edited:

jje1000

Senior Member

Looks like the bubble is deflating? I hope so.

Bidding Wars Turn to Homebuyers’ Remorse in Toronto

https://www.bloomberg.com/news/arti...rs-turn-to-homebuyers-remorse-as-market-slows

Bidding Wars Turn to Homebuyers’ Remorse in Toronto

https://www.bloomberg.com/news/arti...rs-turn-to-homebuyers-remorse-as-market-slows

TheKingEast

Senior Member

When you try to play with the market.....

algotr8der

New Member

Been saying this over and over again. Housing valuation is determined all at the margin. Now that people are waking up and realizing that they were paying inflated prices the activity at the margin is downward.... this will only get worse during the next recession and we are 10 years on after the last one....

Moreover, Moodys downgraded China's debt rating....

Moreover, Moodys downgraded China's debt rating....

TheKingEast

Senior Member

I guess it had nothing to do with government/banks/media doing their best to shut down the market?

You simply can't interfere with the market and not expect to f*** it up.

You simply can't interfere with the market and not expect to f*** it up.

Last edited:

shal1n

New Member

https://www.thestar.com/business/2017/05/26/gta-home-sales-plunge-as-much-as-61-per-cent.html

Its only just beginning... every weekend I see dozens of open house signs at every intersection. I am seeing the same houses with for sale signs for the past 2 months. In the past you couldn't see a house on the market more than a week.

Not like any of this was a surprise.... this is only the tip of the ice berg. So much subprime lending is occurring at non-financial institutions, loads of people who shouldn't have been buying have loaded the boat (especially RE agents)... you really have to dig deep at the street level to understand how deep this goes. I work remotely from coffee shops and over the past 2-3 years I have learned a lot about whats going on, who is buying, why they are buying, how many other properties they have, etc.. Not a single day in the past 12 months has gone by that I have not seen a RE agent with a buyer and over heard their conversations at a starbucks.

Its not just foreigners who are balls to the wall long Toronto real estate. Loads of 30 and 40 something year olds with 5-10 properties each and why not? *its a no brainer* according to most of them that I have over heard during these past 2-3 years.

This is just the beginning of what is coming.

Its only just beginning... every weekend I see dozens of open house signs at every intersection. I am seeing the same houses with for sale signs for the past 2 months. In the past you couldn't see a house on the market more than a week.

Not like any of this was a surprise.... this is only the tip of the ice berg. So much subprime lending is occurring at non-financial institutions, loads of people who shouldn't have been buying have loaded the boat (especially RE agents)... you really have to dig deep at the street level to understand how deep this goes. I work remotely from coffee shops and over the past 2-3 years I have learned a lot about whats going on, who is buying, why they are buying, how many other properties they have, etc.. Not a single day in the past 12 months has gone by that I have not seen a RE agent with a buyer and over heard their conversations at a starbucks.

Its not just foreigners who are balls to the wall long Toronto real estate. Loads of 30 and 40 something year olds with 5-10 properties each and why not? *its a no brainer* according to most of them that I have over heard during these past 2-3 years.

This is just the beginning of what is coming.

Last edited:

TheKingEast

Senior Member

https://www.thestar.com/business/2017/05/26/gta-home-sales-plunge-as-much-as-61-per-cent.html

Its only just beginning... every weekend I see dozens of open house signs at every intersection. I am seeing the same houses with for sale signs for the past 2 months. In the past you couldn't see a house on the market more than a week.

Not like any of this was a surprise.... this is only the tip of the ice berg. So much subprime lending is occurring at non-financial institutions, loads of people who shouldn't have been buying have loaded the boat (especially RE agents)... you really have to dig deep at the street level to understand how deep this goes. I work remotely from coffee shops and over the past 2-3 years I have learned a lot about whats going on, who is buying, why they are buying, how many other properties they have, etc.. Not a single day in the past 12 months has gone by that I have not seen a RE agent with a buyer and over heard their conversations at a starbucks.

Its not just foreigners who are balls to the wall long Toronto real estate. Loads of 30 and 40 something year olds with 5-10 properties each and why not? *its a no brainer* according to most of them that I have over heard during these past 2-3 years.

This is just the beginning of what is coming.

Settle down.

I am house hunting. Things are still selling fast (day of, next day) at ask or over.