Envisioned as one of the largest developments in Canadian history, the re-imagining of Toronto's Unilever Site could deliver a radically intensified urban context to a 60-acre remnant of 20th-century industry. Now marketed as 'East Harbour,' First Gulf's vision proposes calls for the vacant brownfield site to be transformed into one of the city's primary commercial hubs, employing up to 50,000 people across some 11.5 million ft² of new office space. Prepared by OMA and Adamson Associates, a master plan for the site offers a preview of the area's possible future.

A preliminary rendering of the East Harbour Community, image via First Gulf

A preliminary rendering of the East Harbour Community, image via First Gulf

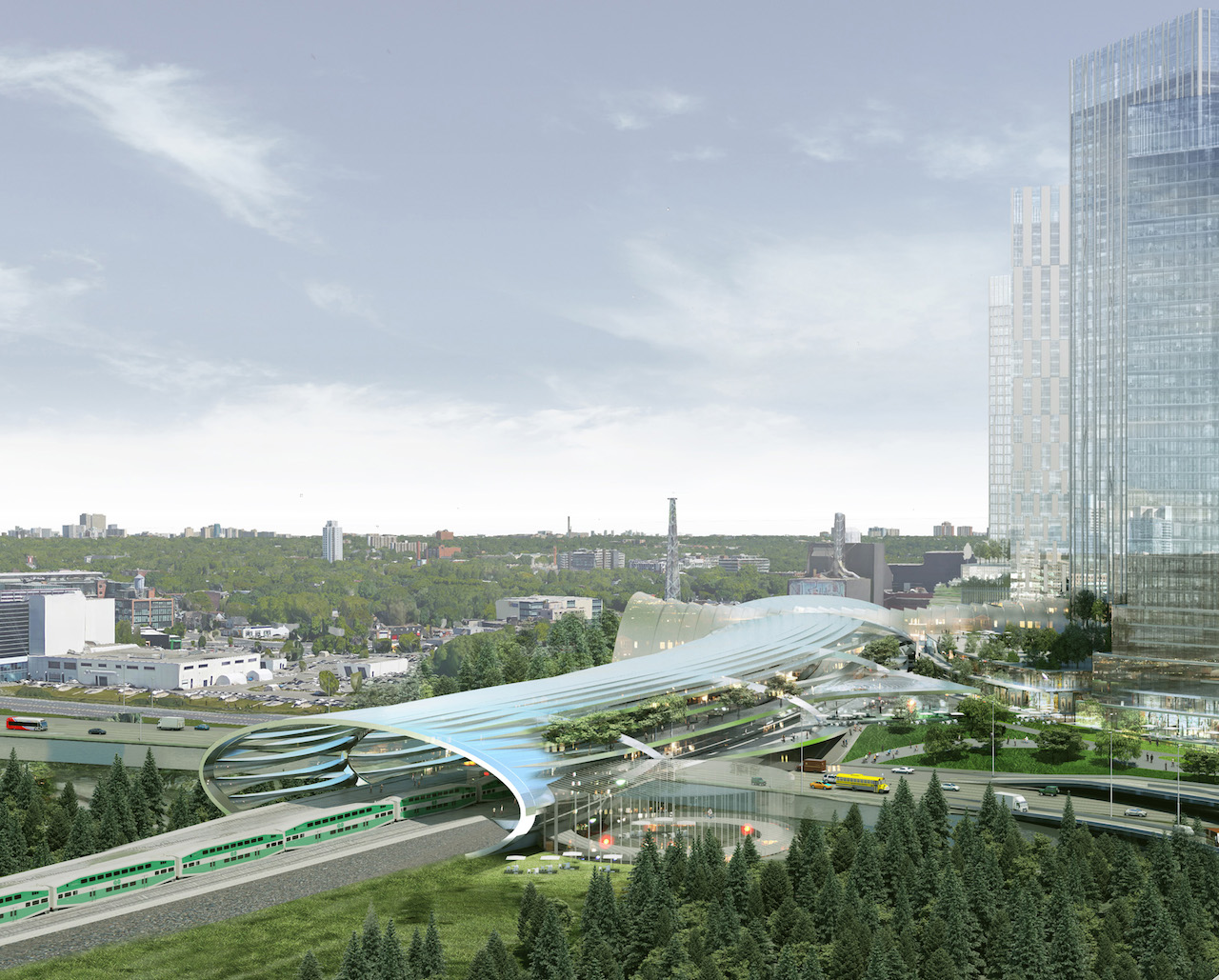

While plans for the development remain at a relatively formative stage, the project's viability is in large part predicated on the creation of a massive multi-modal transit hub. Boasting an eye-catching preliminary design spread across a massive scale, the conceptual transit hub would integrate the TTC's Relief Line with SmartTrack / GO RER, the East Bayfront LRT, and an extended Broadview streetcar. Linking the subway with GO's Lakeshore East and Stouffville Lines—both enhanced by all-day service—the imagined facility would be second only to Union Station in regional volume, making the surrounding area a feasible economic centre.

The curving station would be an uncommon feat of engineering, image courtesy of First Gulf

The curving station would be an uncommon feat of engineering, image courtesy of First Gulf

Of those future transit facilities, so far only the GO RER station, announced this past summer as part of Metrolinx's funded 10 year plan, has a certifiably likely future. With that in mind, the plans shown here reflect both hope and anticipation, depicting the kind of dense urban fabric that could be if the dominos of the city's ambitious transit plans fall into place. Nonetheless, the schematic reveals the broad scope of First Gulf's current vision for the community.

Another view of the site, showing the smaller phase 4 buildings in front, image via First Gulf

Another view of the site, showing the smaller phase 4 buildings in front, image via First Gulf

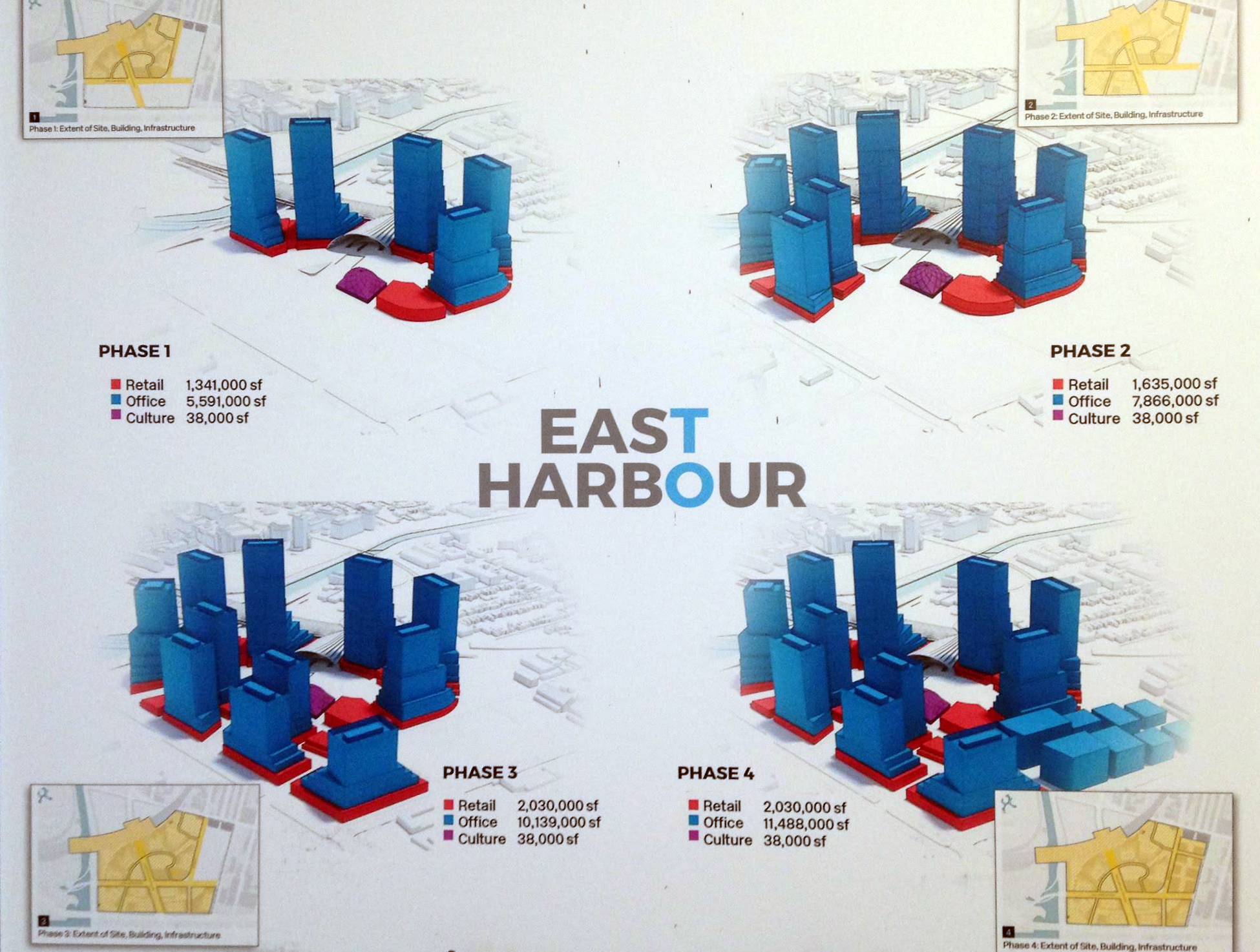

Clustered around an expansive oval-shaped open space, a ring of eight office towers—characterized by terraced massing along the lower levels—accounts for much of the planned commercial space. Along with three outer towers, the 11 high-rise commercial buildings all feature retail-dominated podiums, creating a pedestrian-oriented shopping district at street level. Meanwhile, the central square's 38,000 ft² pavilion would apparently house cultural programming.

A scale model shows the central public space, image via UT Forum

A scale model shows the central public space, image via UT Forum

At the east end of the site, the smaller cluster of mid-rise office buildings—this time without street-level retail—negotiates a transition down to the surrounding neighbourhood's low-rise urban scale. While the Unilever factory itself will make way for new development, the east side of the site will see a number of heritage industrial buildings (bottom right, below) adapted to house communal amenity space.

The existing Unilever site, image via First Gulf

The existing Unilever site, image via First Gulf

Although the renderings (and model) seen here depict a largely uniform aesthetic, these visuals are not strongly indicative of the development's architectural design. Instead, they serve to depict the general massing planned for the community, with the work of designing the buildings themselves set to be divided amongst a number of firms. If the project moves forward, the developers have indicated that a variety of architectural styles will be sought, bringing a more textured, individualized quality to each structure.

A closer look at potential commercial programming, image via First Gulf

A closer look at potential commercial programming, image via First Gulf

The massive development would be built out in four phases, beginning at the end of the decade and lasting throughout—and perhaps beyond—the 2020s. In total, the plan calls for just over 13.5 million ft² of GFA. While the lion's share of the space is given over to office uses, over 2 million ft² are allocated towards retail, potentially creating one of the city's largest shopping destinations. (By comparison, the recently expanded Yorkdale Mall now boasts just under 1.9 million ft²).

The phasing plan, image via First Gulf

The phasing plan, image via First Gulf

Complementing the dramatic influx of density, retail, and new public space, the developers envision the site as a high-tech commercial hub. As quoted by the Toronto Star when plans were first revealed in March of this year, First Gulf's Derek Goring sees investment in sustainability, driverless technology, fibre optics, and experiential retail, as important elements of the project.

While the master plan seen here lays out a fairly comprehensive vision for the site, the project is likely to evolve significantly throughout the planning process. In particular, the commercial density may be challenged by City Planning, with some observers are already calling for a more mixed-use community with residential components. While the land is currently zoned as "employment lands"—which are often threatened by residential development—the scope of this site could lead to a diversification of uses, bringing 24-hour activity to the area. Meanwhile, the composition of the central public space—which may be seen as overly monolithic—may also be refined as the project evolves.

On November 23rd, the master plan proposal will be assessed by the City of Toronto's Design Review Panel for the first time. Along with affording a more in-depth look at the plans, the review is likely to deliver further indication of the City's concerns for the site, giving us a better idea of how the project could take shape in the years to come.

***

We will keep you updated as more information about the project becomes available, and the massive development continues to take shape. In the meantime, you can learn more by checking out our dataBase file, linked below. Want to share your thoughts? Leave a comment in the space below, or join the conversation in our Forum.

| Related Companies: | Adamson Associates Architects, Entuitive, Urban Strategies Inc. |

13K

13K