Northern Light

Superstar

Just setting up this thread because I didn't see a logical place to drop 2 related reports headed to the Sept 9th meeting of TEYCC.

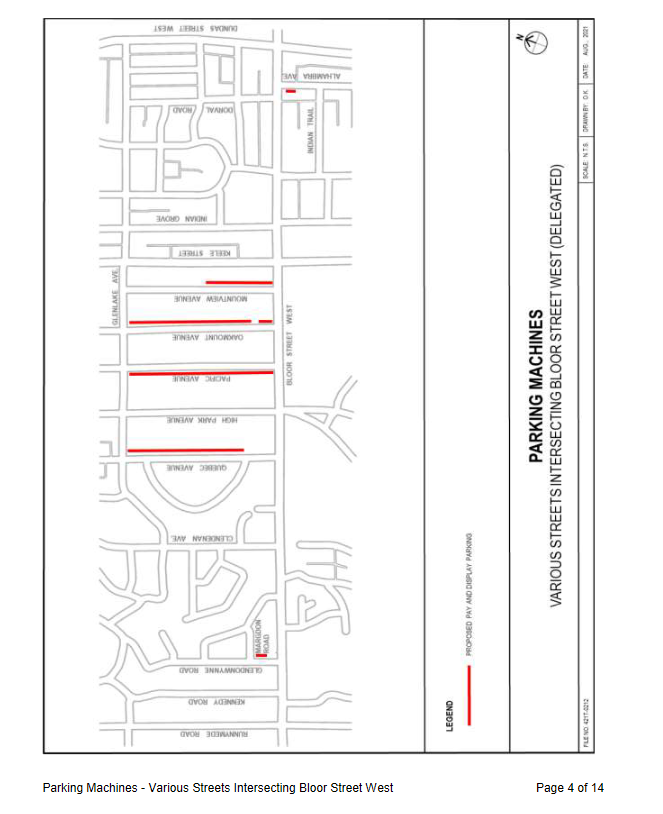

Those reports concern the loss of parking that occurred when Bloor West go Cycle Tracks from Shaw to Runnymede.

What's really good news in these reports, to me, and therefore worth posting about, is that the City is seeing to address this by eliminating free parking on nearby side streets in favour of paid parking!

I have personally advocating for this for some time, and hope this idea spreads to the Danforth!

Report here: https://www.toronto.ca/legdocs/mmis/2021/te/bgrd/backgroundfile-170116.pdf

From said report:

****

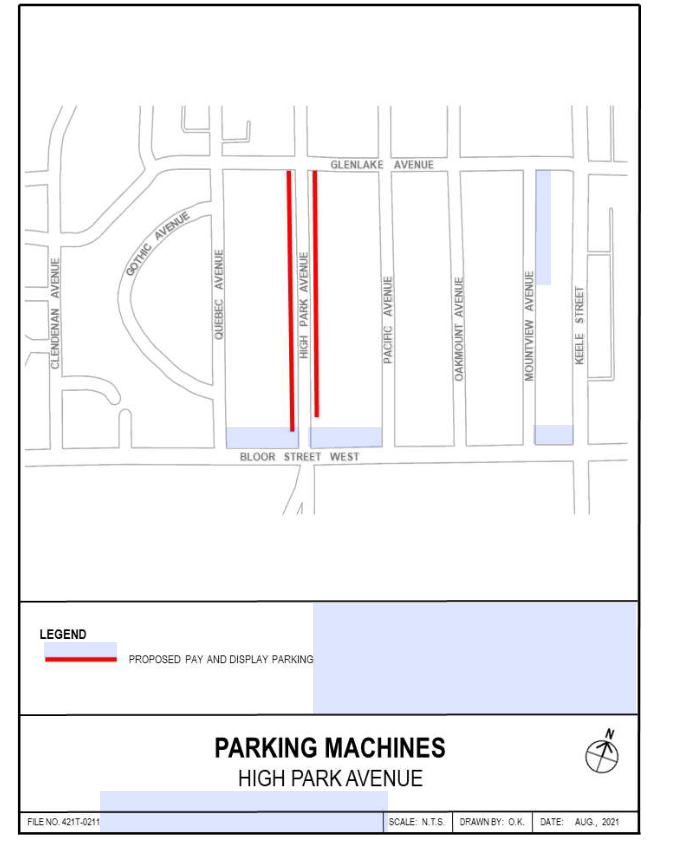

An additional report, really on the same subject, concerns High Park Avenue, because the road has TTC Service and therefore full Council will have to approve the changes:

Report here: https://www.toronto.ca/legdocs/mmis/2021/te/bgrd/backgroundfile-170093.pdf

Those reports concern the loss of parking that occurred when Bloor West go Cycle Tracks from Shaw to Runnymede.

What's really good news in these reports, to me, and therefore worth posting about, is that the City is seeing to address this by eliminating free parking on nearby side streets in favour of paid parking!

I have personally advocating for this for some time, and hope this idea spreads to the Danforth!

Report here: https://www.toronto.ca/legdocs/mmis/2021/te/bgrd/backgroundfile-170116.pdf

From said report:

****

An additional report, really on the same subject, concerns High Park Avenue, because the road has TTC Service and therefore full Council will have to approve the changes:

Report here: https://www.toronto.ca/legdocs/mmis/2021/te/bgrd/backgroundfile-170093.pdf