urbandreamer

recession proof

I never said prices will pick up this year. Spring 2011 should be good though. Look at the stock market--kaboom. RE will follow.

what happened to your prediction that sales and prices are going to pick up later this year ?

In fairness to UD, short term little blips are difficult to predict. For eg. all these projects hitting the market in November, a slower time on the market may drive short term prices down or result in incentives but I get that UD is now suggesting that in the spring of 2011 things may go up.

I guess the question for all of us regulars is: If we accept perhaps a short term dip how many of us think it will be short term and then march upward vs. how many feel if we start with price decreases they will continue through 2011. Afterall, that is really the more important question isn't it as it would influence presumably your decision to either buy now if in the market when it drops before it rebounds or view it as a sign to get out of the market, possibly sell or at least stay on the sidelines.

I'll stick out my neck. I think we may get a short term uptick due to the QE to be announced and the prolonged lower interest rates. However, with all the projects to be released, I agree with the previous poster who said that of about 29 projects, he thought a number would be cancelled redesigned or postponed. I think that number will be about 40% of them personally. That there are 4 releases in this area that are targeting I assume similar markets does not bode well and may just result in a downturn on prices. I do not expect to see price increases in 2011 UD. I hope personally just for some stability in prices or slight orderly declines and hopefully not too deep.

I think he just F*$*$*$ with people most of the time.

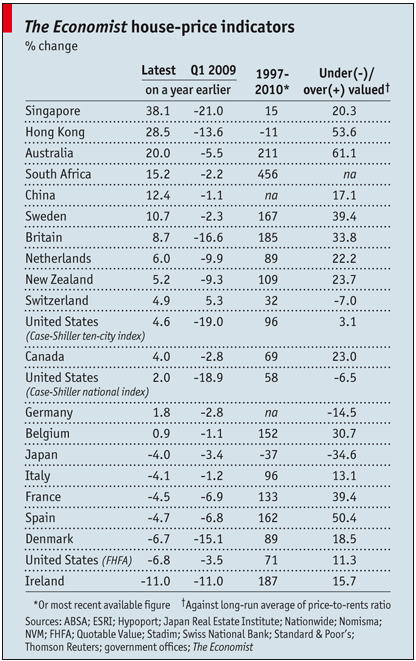

Perhaps someone smarter than me can help draw more useful conclusions from this.

That study by the economist is based on long-run average of price-to-rents ratio. Bad indicator because most apartment rental stock is in Quebec and Ontario that have rent controls so its difficult to get a higher rents