Canada maintains top spot as the most tax competitive country for business globally: KPMG Study

12 July 2016

Toronto, Vancouver and Montreal lead the rankings of international cities for tax competitiveness

Today, KPMG in Canada released its biennial

Competitive Alternatives 2016: Focus on Tax report, revealing that Canada once again tops the list as the most tax competitive country for business globally. Canada’s top international ranking is attributed to low corporate tax rates combined with moderate statutory labour costs, as well as low goods and services tax/harmonized sales tax. The United Kingdom ranked second with the Netherlands taking third place in terms of tax competitiveness.

The supplementary

Focus on Tax 2016 report assesses the tax competitiveness of 111 cities in 10 countries featured in the

Competitive Alternatives study KPMG released earlier this year. The supplementary report also focuses on tax comparisons for 51 major international cities.

“This year’s

Focus on Tax report reinforces Canada’s position as an attractive option for businesses looking to relocate and expand their operations,” said Jodi Kelleher, National Leader, International Tax, KPMG. “As our economy continues to rebound, this provides more positive news for the provinces and cities featured in the study.”

According to the study results, all 17 of the featured Canadian cities have lower total effective tax costs when compared to all US cities featured. During the study period (based on tax rates effective/announced as of January 1, 2016), St. John, NFLD emerged as the most tax competitive city in Canada followed by Fredericton, NB and Moncton, NB.

Toronto, Vancouver and Montreal held three of the top four spots among the 51 major international cities (with a population of two million or more) ranking first, second and fourth, respectively. Manchester, UK placed third.

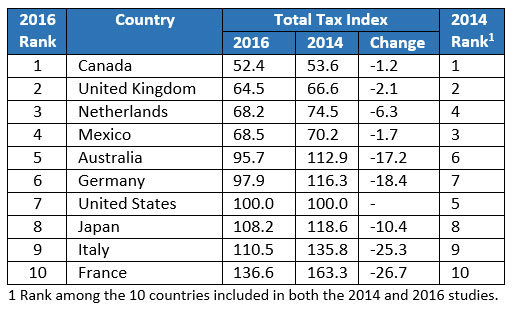

Total tax costs are compared between countries and cities using a Total Tax Index (TTI) for each location. The TTI is a measure of the total taxes paid by companies in a particular location, expressed as a percentage of total taxes paid by similar firms in the US. As the benchmark country, the US has a TTI of 100.0. This study also defines a second measure of total taxes, which expresses tax costs as an effective rate, rather than an index of taxes actually paid. This measure is the Total Effective Tax Rate (TETR), which is calculated as: Total taxes paid by a corporation divided by Standardized net income before income tax.

Results by country

[...]