Northern Light

Superstar

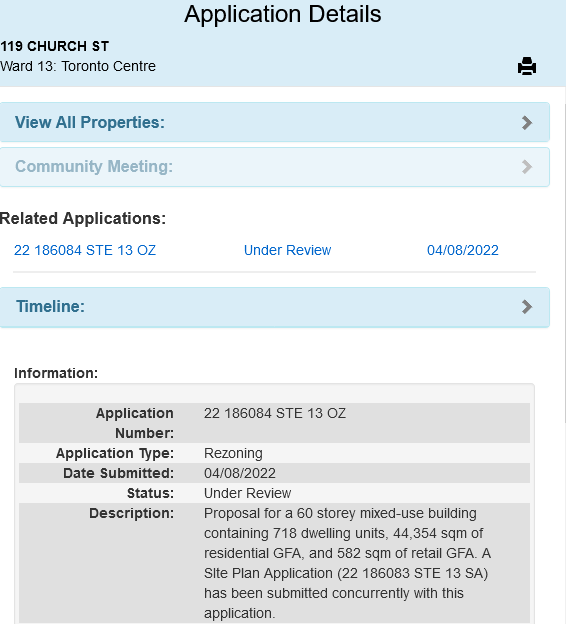

@AlbertC 's discovery now has a formal application in the AIC:

app.toronto.ca

app.toronto.ca

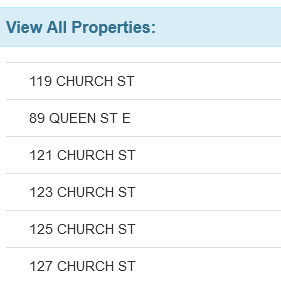

The complete list of properties assembled is thus:

Which bares a resemblance to a post I made above.

Oh........

And...

* Docs are Up *

Architect is IBI

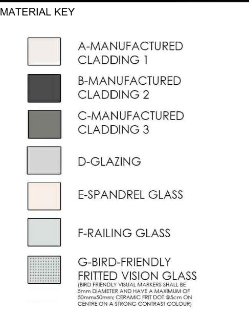

Material Board:

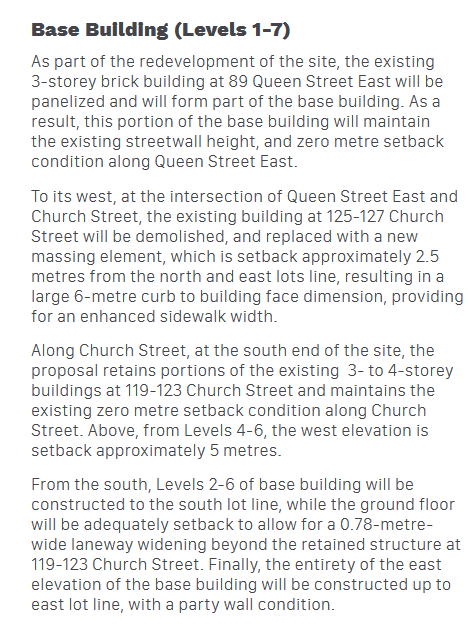

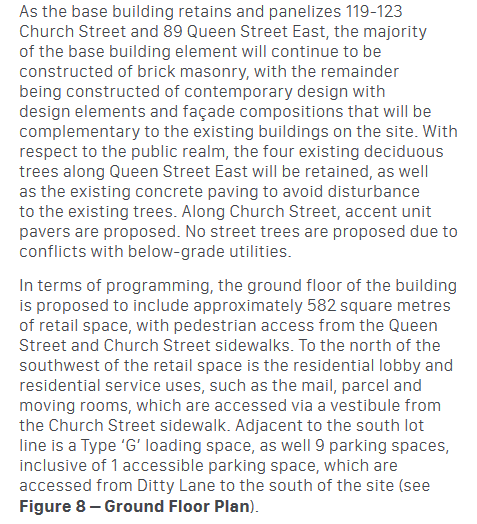

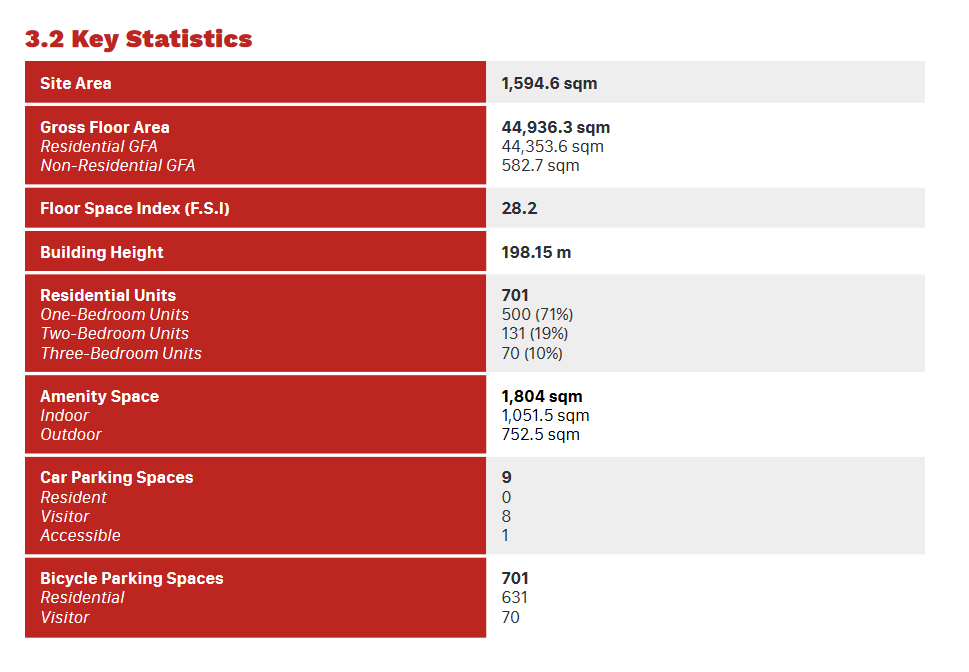

Planning Report:

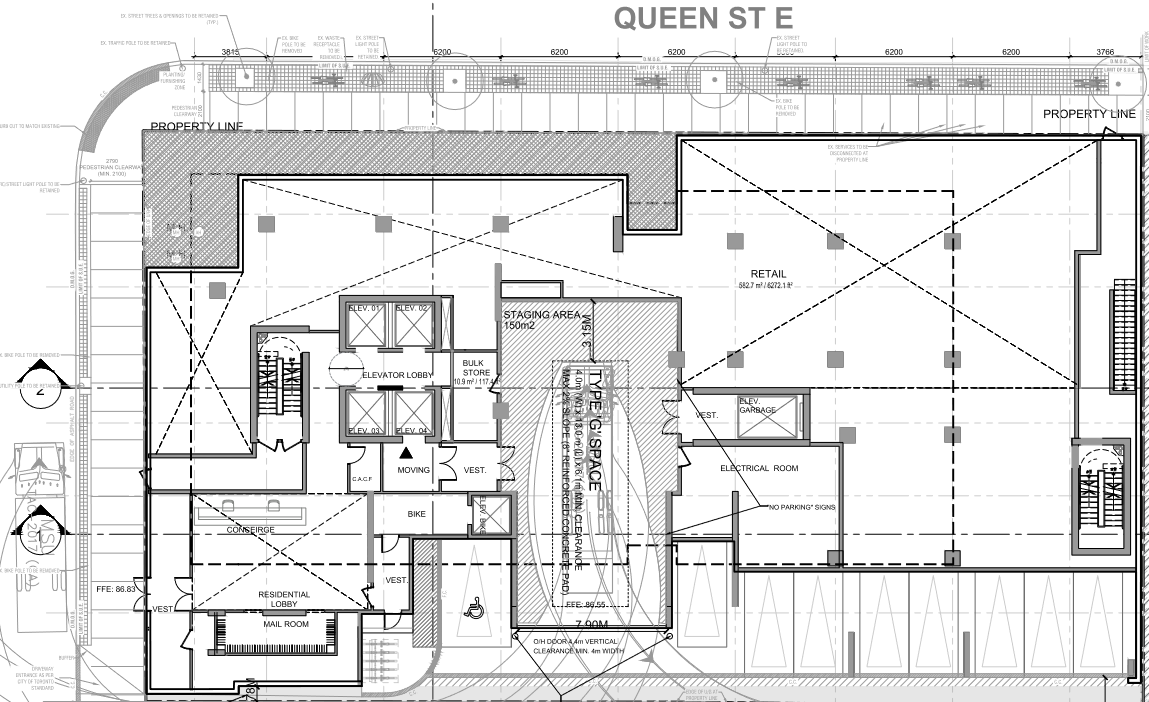

Comments: Podium is a miss, needs a re-think. The way the new meets the old does not work for me. The zero residential parking is great, but the incorporation of visitor parking, and loading at-grade and other choices serve to make the lobby far too prominent in this location.

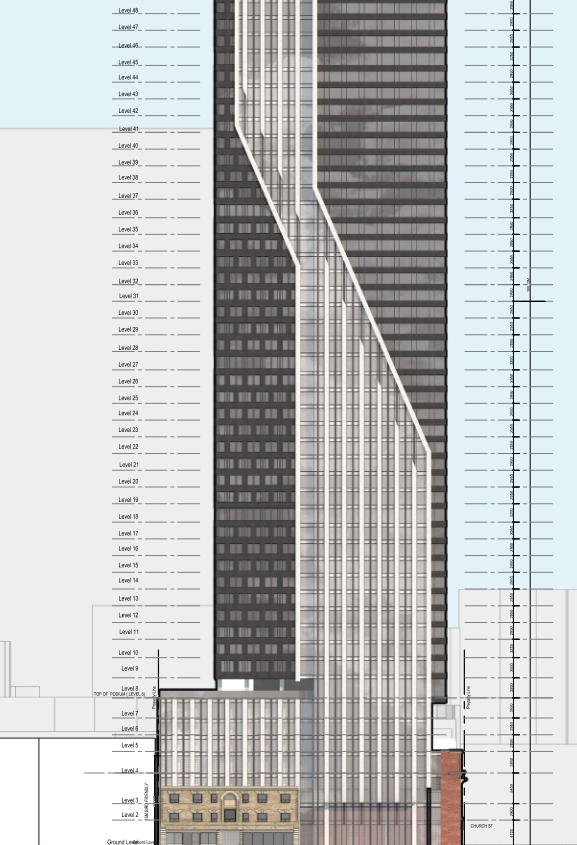

Tower: Too busy, has potential, but needs less going on.....

Heritage: More retention (deeper) on the buildings being retained would desirable, even if only an elevation/facade. South elevation should be preserved or re-built. Treatment of retained facades is off.

Landscape Plan: No new trees, no enhancement to planting conditions of any existing trees, unacceptable.

Missed opportunity:

This laneway space could be made so interesting........old school Toronto brick surface, ivy growing, old-school lighting and/or uplighting of architectural features.

Side Note: City Planning managed to put this one on the map in Weston!

Application Details

The complete list of properties assembled is thus:

Which bares a resemblance to a post I made above.

Oh........

And...

* Docs are Up *

Architect is IBI

Material Board:

Planning Report:

Comments: Podium is a miss, needs a re-think. The way the new meets the old does not work for me. The zero residential parking is great, but the incorporation of visitor parking, and loading at-grade and other choices serve to make the lobby far too prominent in this location.

Tower: Too busy, has potential, but needs less going on.....

Heritage: More retention (deeper) on the buildings being retained would desirable, even if only an elevation/facade. South elevation should be preserved or re-built. Treatment of retained facades is off.

Landscape Plan: No new trees, no enhancement to planting conditions of any existing trees, unacceptable.

Missed opportunity:

This laneway space could be made so interesting........old school Toronto brick surface, ivy growing, old-school lighting and/or uplighting of architectural features.

Side Note: City Planning managed to put this one on the map in Weston!