Home construction in the Greater Toronto and Hamilton Area (GTHA) has continued to lag behind population growth, according to data from Statistics Canada, the Centre of Urban Research and Land Development (CUR), and UrbanToronto's UTPro: only one new dwelling unit was completed for every nine newcomers to the region over a one-year period.

Etobicoke's Humber Bay Shores skyline with Mississauga City Centre in the background, image by UrbanToronto Forum contributor steveve

Etobicoke's Humber Bay Shores skyline with Mississauga City Centre in the background, image by UrbanToronto Forum contributor steveve

The CUR reports that the City of Toronto saw a net increase in population of 143,000 people in the twelve months ending July 1, 2024. When you add in the population changes to Peel, Halton, Durham, York, and Hamilton — the GTHA — you get an increase in population of 299,000 thousand people across the GTHA in just one year. This isn't just a blip, as these numbers are similar to the population increases in the previous year. The CUR goes on to report that a "surge in immigrant and non-immigrant" migration to the area has accounted for the bulk of the population growth.

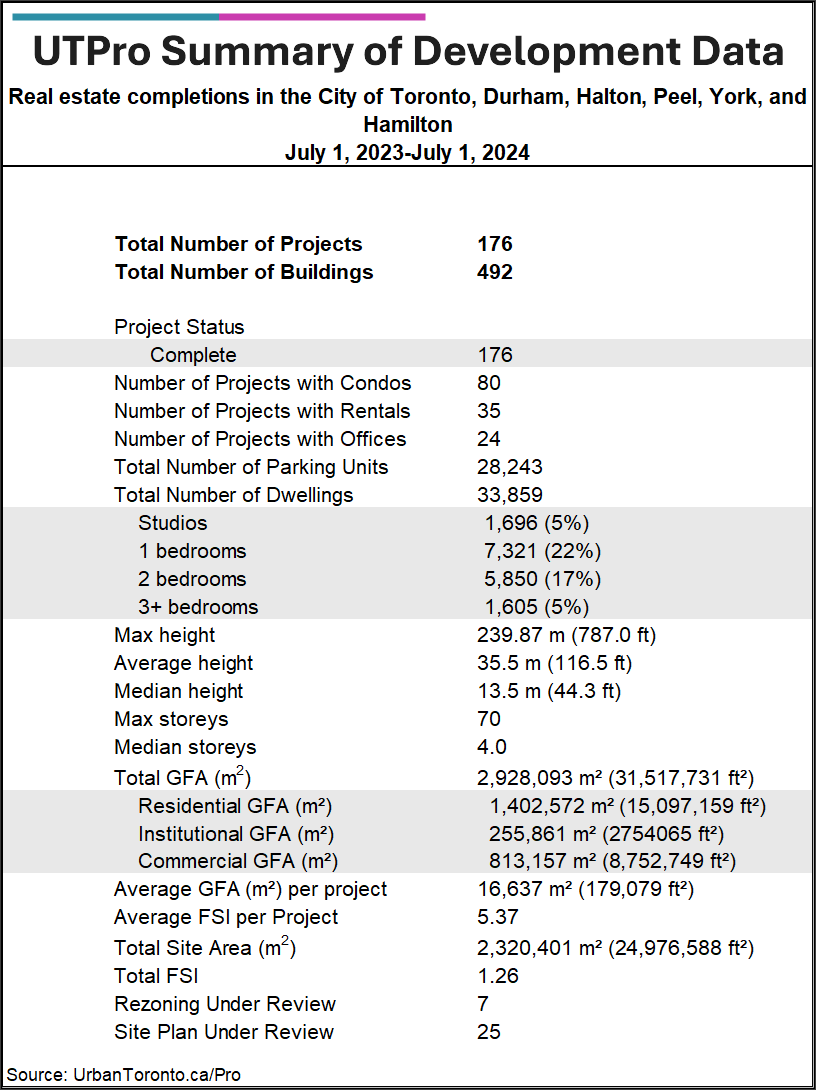

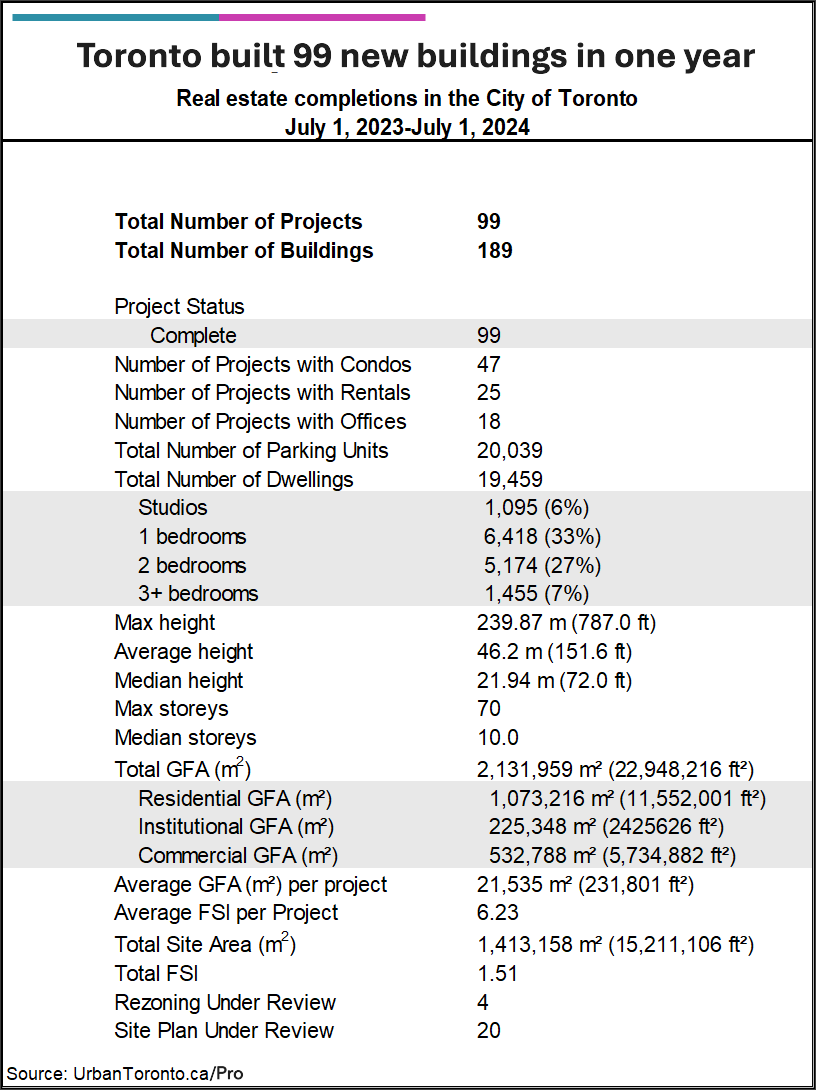

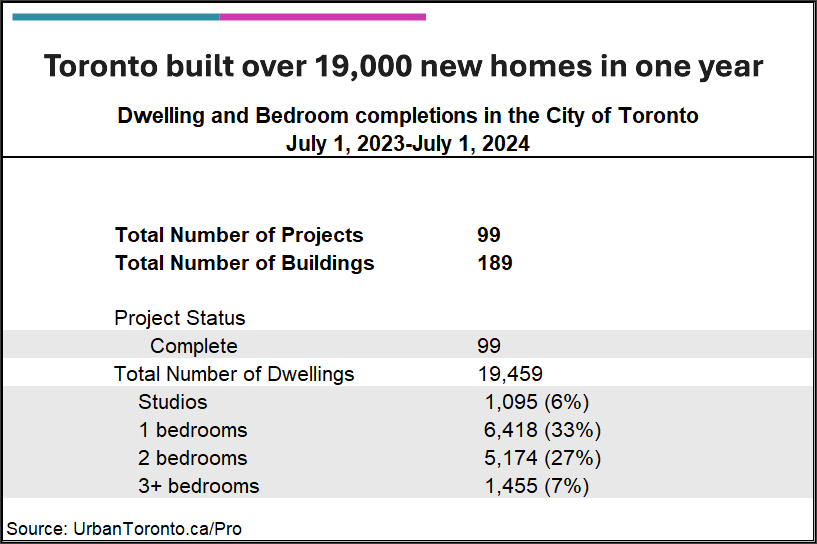

But looking at construction data from UrbanToronto's UTPro reveals that the region has not been building new housing at the same rate. Across the entire GTHA, UTPro tracked only 33,859 new dwelling units completed during the same timeframe: 19,459 units in the City of Toronto, and 14,400 in the regions of Durham, Halton, Peel, York, and Hamilton.

Supply and Demand

Obviously, there are many different types of "dwellings," from studio apartments to 3+ bedroom detached homes. The more bedrooms are being constructed, the more people can fit comfortably in one dwelling.

However, these numbers are not improved by focusing on the number of bedrooms instead of the number of homes. Looking specifically at the City of Toronto, we can even see that only 22,226 bedrooms were completed in that year. If the 143,000 new residents to the city were only moving into these new homes, Toronto developers only built enough homes to fit 6 people per bedroom.

Since we would expect a national crisis if every single new condo were being packed with six or 12 immigrants, we can conclude that this is not what's happening. So where are the new Torontonians going? The answer has to be filling the empty bedrooms, or putting more people into each bedroom in existing housing developments.

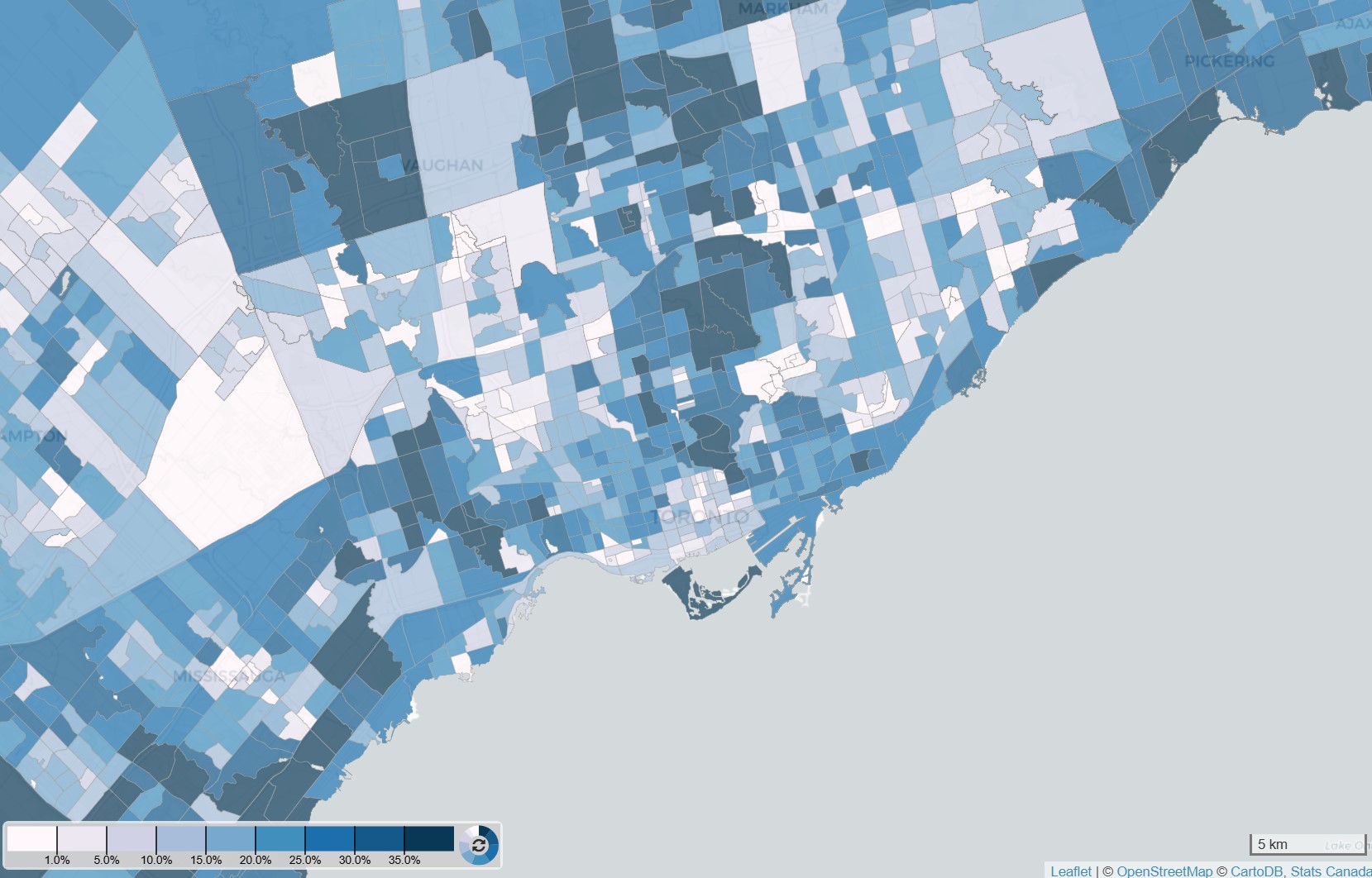

In 2021, Statistics Canada estimated that large areas of Toronto had 20-30% "unoccupied" bedrooms. Pre-existing bedrooms offered for rent for the first time have the same economic impact as constructing new bedrooms, in terms of their impact on prices. But quality of life is different when living with a stranger in an older home, versus living with your immediate family in something newly-built.

Figure 4. Estimated number of unoccupied bedrooms in the Toronto area. Data from Statistics Canada, map courtesy of Censusmapper.ca

Figure 4. Estimated number of unoccupied bedrooms in the Toronto area. Data from Statistics Canada, map courtesy of Censusmapper.ca

Are Macroeconomic Conditions Really the Limiting Factor?

The natural question to ask is, why have Toronto developers been so slow to build over the last year? The most common justifications often heard are macroeconomic: interest rates affecting borrowing costs for both developers and buyers, inflation affecting the costs of labor and materials, and global political uncertainties (although this was less of an issue between July 2023 and July 2024).

However, if these macroeconomic forces were the primary cause of the Toronto region's construction slump, they would surely be affecting other cities outside of the Toronto region. But according to the CMHC, while Toronto had declining new housing starts in 2024, Montreal and Vancouver saw increased housing starts during the same time period.

This must mean that whatever the cause of the Toronto region's slump on new construction, it must have a very strong local effect: either municipal or provincial regulations that have increased the cost in excess of the macroeconomic factors. this is an understudied topic, and to answer it goes beyond the scope of this article.

Conclusion

While the population in the Toronto area boomed in the year leading up to July 2024, new construction and completions by large developers lagged far behind. This implies that most new Torontonians had to move in to existing housing stock, whether that was occupying previously unoccupied bedrooms, or overcrowding already-occupied bedrooms.

While there must be supply-side factors to explain why Toronto developers are not building more to meet this increased demand, the ultimate cause must be due to local (as opposed to national) conditions. These likely include either municipal or provincial tax and other regulatory burdens that increase the cost of construction. The true cause is not yet clear.

What is clear, however, is that Toronto’s housing market is at a breaking point. The city continues to welcome record numbers of new residents, yet new construction remains sluggish, forcing newcomers into existing housing stock in ways that likely increase competition, drive up rents, and strain affordability.

If this trend continues, it will further exacerbate Toronto’s already well-documented housing crisis. Without significant policy changes—whether through streamlined zoning approvals, incentives for purpose-built rentals, or reduced regulatory barriers—developers will remain constrained, and supply will continue to fall short of demand.

* * *

If you're interested in the data used to generate this report, you can get more details on the official UTPro page. Explore the full capabilities of UTPro to see how its powerful insights can support your vision for the future of the Greater Golden Horseshoe. Contact us with your queries or to schedule a demo.

If you would like to stay updated on the latest development news on a daily basis, UrbanToronto also offers New Development Insider, a daily subscription newsletter delivered directly to your inbox.

609

609