The Toronto Real Estate Board (TREB) has released their commercial and housing figures for the month of November, showing continued strength in both markets. 6,519 residential transactions went through the TorontoMLS system during the month, an increase of 2.6% when compared to the 6,354 sales reported in November of the previous year. Sales during the first eleven months of the year totalled in at 88,462, marking a 6.6% increase when compared to the same period last year. Year-over-year sales continued to see growth last month, but the supply of listings remained limited, with the number of active listings down from the same period last year.

Toronto's Financial District, image by Flickr contributor Empty Quarter

Toronto's Financial District, image by Flickr contributor Empty Quarter

"Even with a constrained supply of homes for sale in many parts of the Greater Toronto Area, buyers continued to get deals done last month" said TREB President, Paul Etherington. "Households remain upbeat about home ownership because monthly mortgage payments remain affordable relative to accepted lending standards. This is coupled with the fact that housing has proven to be a quality long-term investment".

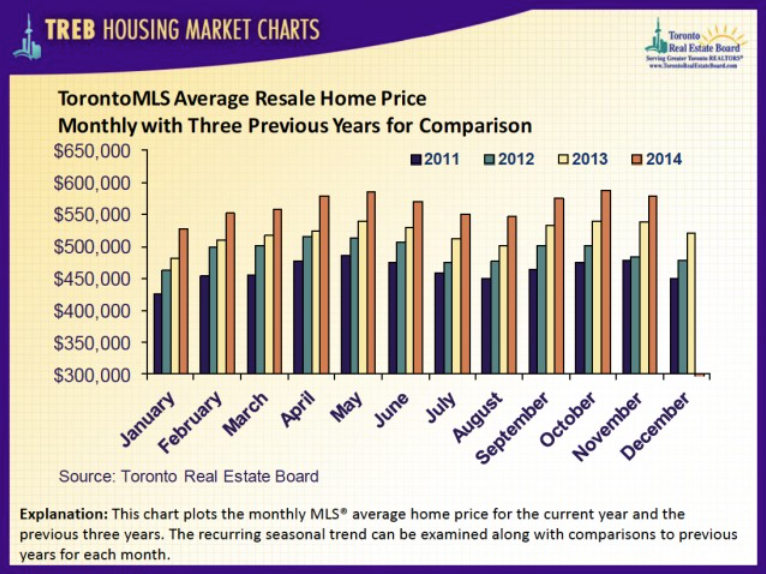

The average selling price for November transactions rose to $577,936, marking a 7.4% year-over-year increase, while the year-to-date average price jumped by 8.4% to $567,198. "The robust average price growth experienced throughout 2014 has been fundamentally sound, with demand high relative to supply. Strong competition between buyers has exerted upward pressure on selling prices. Barring a substantial shift in the relationship between sales and listings in the GTA, price growth is expected to continue through 2015," said Jason Mercer, TREB's Director of Market Analysis.

TorontoMLS Average resale home price, image courtesy of TREB

TorontoMLS Average resale home price, image courtesy of TREB

Monthly figures also show plenty of movement in the commercial market, though not all of the numbers are positive. The 470,604 square feet of industrial, commercial/retail and office space leased within the TREB market area show a 25% decrease when compared with the 624,924 square feet of combined space leased in November of last year. Out of the total 470,604 square feet leased, almost 80% was accounted for by the industrial market.

Average lease rates in November for industrial and commercial/retail properties were up to $5.29 per square foot net and $22.31 per square foot net respectively, compared with last year's figures, while average office lease rates were down 5.2% to $13.27 per square foot.

“The demand for commercial real estate, whether for lease or for sale, can be volatile on a monthly basis when comparing to the previous year. With this said, recent economic data suggests that we could see an uptick in the demand for commercial space moving forward, given that the Canadian economy expanded at a relatively strong pace over the past two quarters." said Paul Etherington. "On top of this, the dip in the value of the Canadian dollar vis-à-vis the US could result in increased demand for goods produced in the GTA for export south of the border. This could lead to an increase in the demand for industrial space in the GTA as well.”

The number of combined industrial, commercial/retail and office transactions remained unchanged from the same period in 2013, with 67 total transactions for which pricing was disclosed. Based on a per-square-foot basis, average sale prices were turbulent in November, exhibiting both ups and downs in the market segment in question. It is worth noting that average price changes can be caused by a number of factors, including changes in the type and location of properties sold. Price change during November 2014 was largely the product of a change in the types of properties sold compared to last year.

717

717