EnviroTO

Senior Member

I posted this in another thread in response to yet another news article where Toronto has no money and is begging to the province and federal government for help.

Common themes:

Common themes:

- Toronto is special.

- The city spent money on a study to make the city great, or has some idea to make the city great... but some other level of government needs to pay for it.

- Province does everything wrong, federal government does everything wrong, and the city is perfect.

- The city continues to avoid taking the steps to make a truly balanced budget protecting homeowners who have benefited greatly from growth in property values and all the other benefits from the economy we had over the past 15 years with low interest rates.

- The greatest residential tax rate burden is on older multi-residential buildings and passed on to the renter (the people who have benefited the least from growth in property values).

- The greatest residential tax rate on older multi-residential buildings is being levied on the most efficient to service property (for 100 residences there is one water pipe hook up, one sewer hookup) and community costs are covered by the building (pipes, walkways/hallways, driveways) that in a subdivision would have been a city expense.

- The city continues to do studies (which costs money because staff are not free) when there is no money being saved to pay for the actual implementation of these things.

- Capital expenses, including ones to deal with end of service life replacements, keep being deferred and the future isn't cheaper.

- City councillors that have their own level of government to manage calling out the mismanagement of things outside their jurisdiction without cleaning up their own backyard.

- This is the largest city in Canada so there are more people to divide the costs over.

- The city in general is more compact and dense than others which means there should be cost efficiencies for capital expenses and their maintenance. A 100m of pipe serves more people, 100m of sidewalk serves more people, 100m of road serves more people,etc.

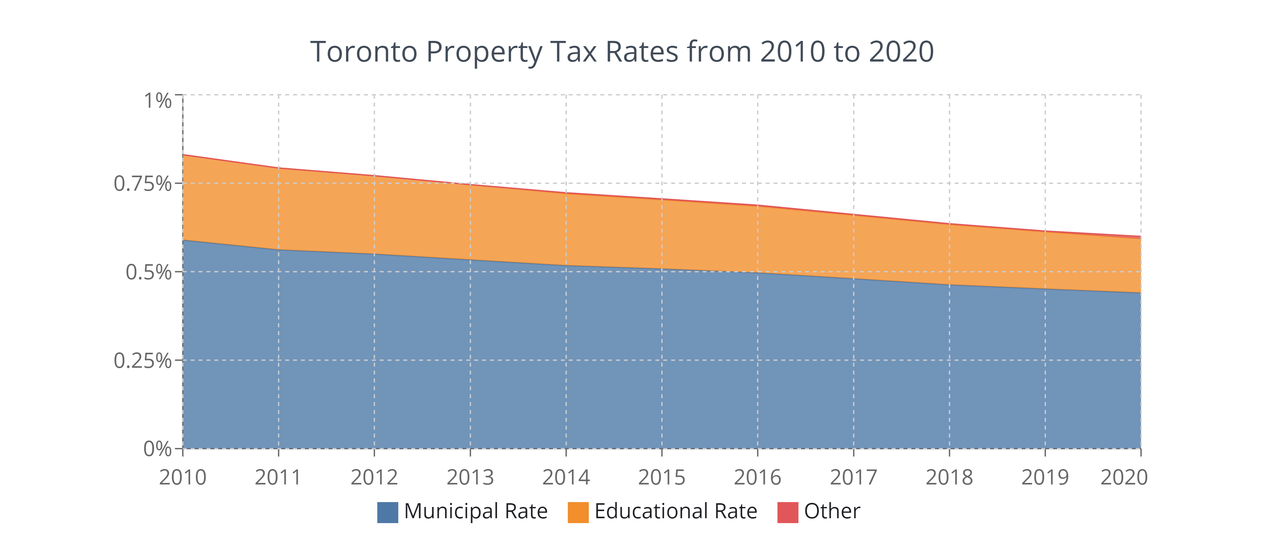

- One of the reasons for unaffordable housing costs (besides the long period of low borrowing costs allowing people to continually sell over asking price) is pure market economics and what people can afford. The dwindling property tax rate as compared to other residential costs made it possible for people to afford / drive-up the costs of housing without any benefit to the city.

- The city needs to stop planning for shiny new things when it can't afford what it has. Look at what is in the backlog, inventory all the existing services being provided, and get real.

- The city needs to spend less time discussing the inadequacies of other levels of government, and focus on what they have the power to change considering they were not elected to manage provincial or federal projects.

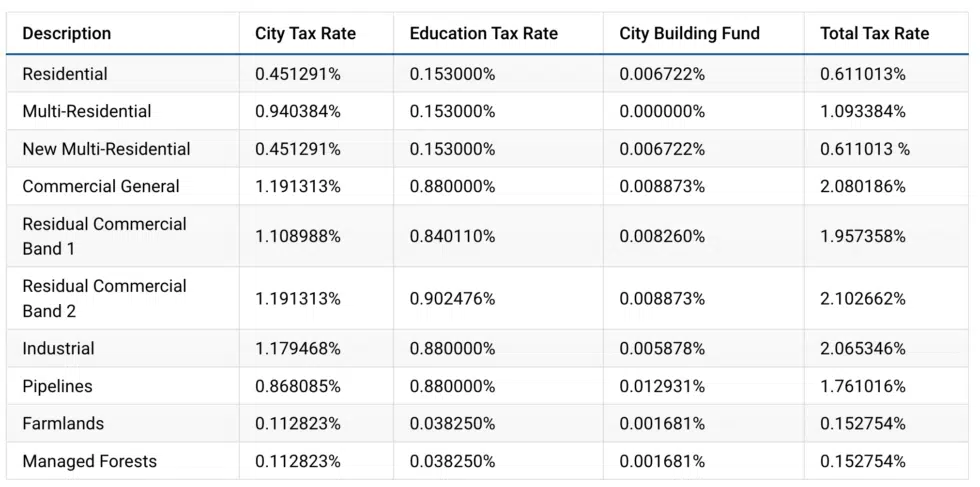

- The city tax rate should be mid-pack with other Ontario communities before complaining about how broke it is. If the multi-residential rate of 0.94% makes sense for the most efficient use of land and infrastructure, then it should make sense for the least efficient use of land and infrastructure.

| City | Avg Home | Home Rank | Tax Rate | Tax Rate Rank | Tax | Tax Rank |

| Caledon | $1,709,975 | 1 | 0.80% | 24 | $13,680 | 1 |

| Windsor | $714,650 | 22 | 1.81% | 1 | $12,935 | 2 |

| Whitby | $991,105 | 12 | 1.12% | 17 | $11,100 | 3 |

| Oakville | $1,487,485 | 2 | 0.72% | 30 | $10,710 | 4 |

| Pickering | $981,563 | 14 | 1.08% | 21 | $10,601 | 5 |

| Ajax | $968,767 | 15 | 1.09% | 19 | $10,560 | 6 |

| Orangeville | $783,615 | 18 | 1.33% | 10 | $10,422 | 7 |

| Aurora | $1,363,412 | 3 | 0.76% | 29 | $10,362 | 8 |

| Oshawa | $782,227 | 20 | 1.30% | 11 | $10,169 | 9 |

| Peterborough | $693,871 | 26 | 1.44% | 6 | $9,992 | 10 |

| Brampton | $1,003,263 | 11 | 0.96% | 23 | $9,631 | 11 |

| Hamilton | $782,611 | 19 | 1.20% | 14 | $9,391 | 12 |

| Guelph | $810,200 | 17 | 1.14% | 16 | $9,236 | 13 |

| Newmarket | $1,124,974 | 7 | 0.79% | 26 | $8,887 | 14 |

| Barrie | $729,500 | 21 | 1.21% | 13 | $8,827 | 15 |

| London | $630,282 | 29 | 1.38% | 8 | $8,698 | 16 |

| Kingston | $636,150 | 28 | 1.36% | 9 | $8,652 | 17 |

| Richmond Hill | $1,317,247 | 4 | 0.65% | 33 | $8,562 | 17 |

| Cambridge | $714,650 | 22 | 1.18% | 15 | $8,433 | 19 |

| St. Catharines | $582,100 | 31 | 1.44% | 6 | $8,382 | 20 |

| Niagara Falls | $640,000 | 27 | 1.30% | 11 | $8,320 | 21 |

| Vaughan | $1,251,465 | 6 | 0.66% | 32 | $8,260 | 22 |

| Burlington | $1,060,052 | 9 | 0.77% | 28 | $8,162 | 23 |

| Markham | $1,282,561 | 5 | 0.63% | 34 | $8,080 | 24 |

| Mississauga | $987,356 | 13 | 0.80% | 24 | $7,899 | 25 |

| Kitchener | $714,650 | 22 | 1.10% | 18 | $7,861 | 26 |

| Waterloo | $714,650 | 22 | 1.09% | 19 | $7,790 | 27 |

| Halton Hills | $966,031 | 16 | 0.79% | 26 | $7,632 | 28 |

| Milton | $1,031,770 | 10 | 0.68% | 31 | $7,016 | 29 |

| Sudbury | $436,000 | 32 | 1.54% | 5 | $6,714 | 30 |

| Toronto | $1,093,097 | 8 | 0.61% | 35 | $6,668 | 31 |

| North Bay | $400,593 | 33 | 1.56% | 4 | $6,249 | 32 |

| Ottawa | $624,003 | 30 | 1.00% | 22 | $6,240 | 33 |

| Thunder Bay | $309,310 | 34 | 1.59% | 2 | $4,918 | 34 |

| Sault Ste. Marie | $296,629 | 35 | 1.58% | 3 | $4,687 | 35 |