W

wyliepoon

Guest

Link to article

Boost infotech in GTA: Report

Toronto's ICT sector lacks cohesion

Must keep up with San Francisco, NYC

Apr. 19, 2006. 08:09 AM

DAVID BRUSER

BUSINESS REPORTER

If it hopes to keep up with New York and San Francisco, the Toronto area's hodgepodge information and communications technology sector needs to band together and hype its brand around the globe or risk watching smaller markets surge ahead.

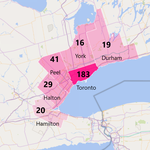

That's the thrust of a new report, spearheaded by the City of Toronto and due out today, that diagnoses an industry employing 148,000 at 3,300 area firms but that is geographically spread out, too loosely affiliated and lacking the kind of unified voice that could get politicians' attention.

"Toronto's ICT sector does not enjoy the recognition of such internationally recognized locales as Silicon Valley, Austin, Boston or Bangalore," the report says. "This inevitably puts Toronto at a disadvantage with respect to attracting foreign and domestic investment. ...The whole is currently less than the sum of its parts."

The 110-page report on what is the third-largest such cluster in North America makes many suggestions, calls for the formation of an umbrella organization of stakeholders to better promote the industry, and urges them to preach the cause to policy makers who ignore the industry.

Funded by the City of Toronto, the provincial Ministry of Economic Development and Trade and federal International Trade Canada, the report states a simple goal: "That the Toronto Region will become, and be acknowledged globally, as one of the five most innovative, creative and productive locations in the world for ICT research, education, business and investment by 2011."

Currently, Toronto is third on the continent, behind San Francisco and New York in total ICT employment.

While the report does not play down the sector's importance economically — with annual sales near $35 billion — it aspires to much by 2011, including:

#

Move from third place in North America in terms of company growth and investment into one of the top two spots.

#

Increase investment in ICT research in the region by 25 per cent.

#

Increase ICT sales and employment by 20 per cent.

#

Attract five new multinational firms to the region.

All of this is in the face of many trends that threaten to undermine the ICT sector, such as firms outsourcing production to low-cost facilities offshore.

Meanwhile, help seems far away, the report says, with government officials and investors preoccupied with "darlings" such as biotechnology and nanotechnology, whose economic impact is negligible.

"Local ICT champions have not come forward to the extent they have in other cities, such as Ottawa or Waterloo," the report says. "Long perceived as Canada's economic `fat cat,' it has been difficult for the Toronto region to attract attention and support from the provincial and federal governments."

In Ottawa, Paul Swinwood, president of the Software Human Resource Council, a not-for-profit group researching employment trends in the information technology sector, agrees the 416 and 905 regions have to unite against "China Inc."

"We are competing against other countries, and small entities standing on their own are not going to make that big a difference," he said. "We have a whole bunch of regional organizations, which are all doing the same sort of thing, trying to sell York Region or trying to sell Mississauga or trying to sell downtown Toronto. And they're trying to sell against China. You have to have both the mass and the clout and the diversity to be able to compete."

The GTA is home to both the York Technology Association and Mississauga Technology Association, while in Kitchener-Waterloo, a single voice, Communitech, provides a central point of contact for investors and marketers, the report says.

Swinwood points to the Ottawa Centre for Research and Innovation, which claims 1,600 member companies from across the region. "There's nothing like that in the 416-905 area," he said.

In the Greater Toronto Area, the sector employs 28,000 in electronic components manufacturing, 48,000 in software and systems development facilities and 64,000 in ICT services such as telecommunications.

But investment capital is typically available only to the major players and deals that can cover investment firms' high overhead and transaction costs, so entrepreneurs seeking smaller amounts get shut out.

"In smaller communities there are fewer sources of investment capital. On the other hand, those funding sources tend to be more open to smaller deals, and entrepreneurs typically find management to be more approachable."

The positives for ICT firms are many, including a large local customer base, easy access to U.S. markets and a skilled workforce. But the report says a new partnership — an association of companies, industry and professional organizations, universities and colleges and governments — would help broadcast that message.

Boost infotech in GTA: Report

Toronto's ICT sector lacks cohesion

Must keep up with San Francisco, NYC

Apr. 19, 2006. 08:09 AM

DAVID BRUSER

BUSINESS REPORTER

If it hopes to keep up with New York and San Francisco, the Toronto area's hodgepodge information and communications technology sector needs to band together and hype its brand around the globe or risk watching smaller markets surge ahead.

That's the thrust of a new report, spearheaded by the City of Toronto and due out today, that diagnoses an industry employing 148,000 at 3,300 area firms but that is geographically spread out, too loosely affiliated and lacking the kind of unified voice that could get politicians' attention.

"Toronto's ICT sector does not enjoy the recognition of such internationally recognized locales as Silicon Valley, Austin, Boston or Bangalore," the report says. "This inevitably puts Toronto at a disadvantage with respect to attracting foreign and domestic investment. ...The whole is currently less than the sum of its parts."

The 110-page report on what is the third-largest such cluster in North America makes many suggestions, calls for the formation of an umbrella organization of stakeholders to better promote the industry, and urges them to preach the cause to policy makers who ignore the industry.

Funded by the City of Toronto, the provincial Ministry of Economic Development and Trade and federal International Trade Canada, the report states a simple goal: "That the Toronto Region will become, and be acknowledged globally, as one of the five most innovative, creative and productive locations in the world for ICT research, education, business and investment by 2011."

Currently, Toronto is third on the continent, behind San Francisco and New York in total ICT employment.

While the report does not play down the sector's importance economically — with annual sales near $35 billion — it aspires to much by 2011, including:

#

Move from third place in North America in terms of company growth and investment into one of the top two spots.

#

Increase investment in ICT research in the region by 25 per cent.

#

Increase ICT sales and employment by 20 per cent.

#

Attract five new multinational firms to the region.

All of this is in the face of many trends that threaten to undermine the ICT sector, such as firms outsourcing production to low-cost facilities offshore.

Meanwhile, help seems far away, the report says, with government officials and investors preoccupied with "darlings" such as biotechnology and nanotechnology, whose economic impact is negligible.

"Local ICT champions have not come forward to the extent they have in other cities, such as Ottawa or Waterloo," the report says. "Long perceived as Canada's economic `fat cat,' it has been difficult for the Toronto region to attract attention and support from the provincial and federal governments."

In Ottawa, Paul Swinwood, president of the Software Human Resource Council, a not-for-profit group researching employment trends in the information technology sector, agrees the 416 and 905 regions have to unite against "China Inc."

"We are competing against other countries, and small entities standing on their own are not going to make that big a difference," he said. "We have a whole bunch of regional organizations, which are all doing the same sort of thing, trying to sell York Region or trying to sell Mississauga or trying to sell downtown Toronto. And they're trying to sell against China. You have to have both the mass and the clout and the diversity to be able to compete."

The GTA is home to both the York Technology Association and Mississauga Technology Association, while in Kitchener-Waterloo, a single voice, Communitech, provides a central point of contact for investors and marketers, the report says.

Swinwood points to the Ottawa Centre for Research and Innovation, which claims 1,600 member companies from across the region. "There's nothing like that in the 416-905 area," he said.

In the Greater Toronto Area, the sector employs 28,000 in electronic components manufacturing, 48,000 in software and systems development facilities and 64,000 in ICT services such as telecommunications.

But investment capital is typically available only to the major players and deals that can cover investment firms' high overhead and transaction costs, so entrepreneurs seeking smaller amounts get shut out.

"In smaller communities there are fewer sources of investment capital. On the other hand, those funding sources tend to be more open to smaller deals, and entrepreneurs typically find management to be more approachable."

The positives for ICT firms are many, including a large local customer base, easy access to U.S. markets and a skilled workforce. But the report says a new partnership — an association of companies, industry and professional organizations, universities and colleges and governments — would help broadcast that message.