The growing collection of office towers under construction in Downtown Toronto is a tangible sign of the high demand for new commercial space in the heart of the city. This demand is highlighted in the latest quarterly office market report from CBRE, which states that the Downtown office market vacancy rate has dropped 20 basis points (bps) measured quarter-over-quarter, reaching a new record low of 2.4%.

Toronto skyline, image by Ryan Debergh

Toronto skyline, image by Ryan Debergh

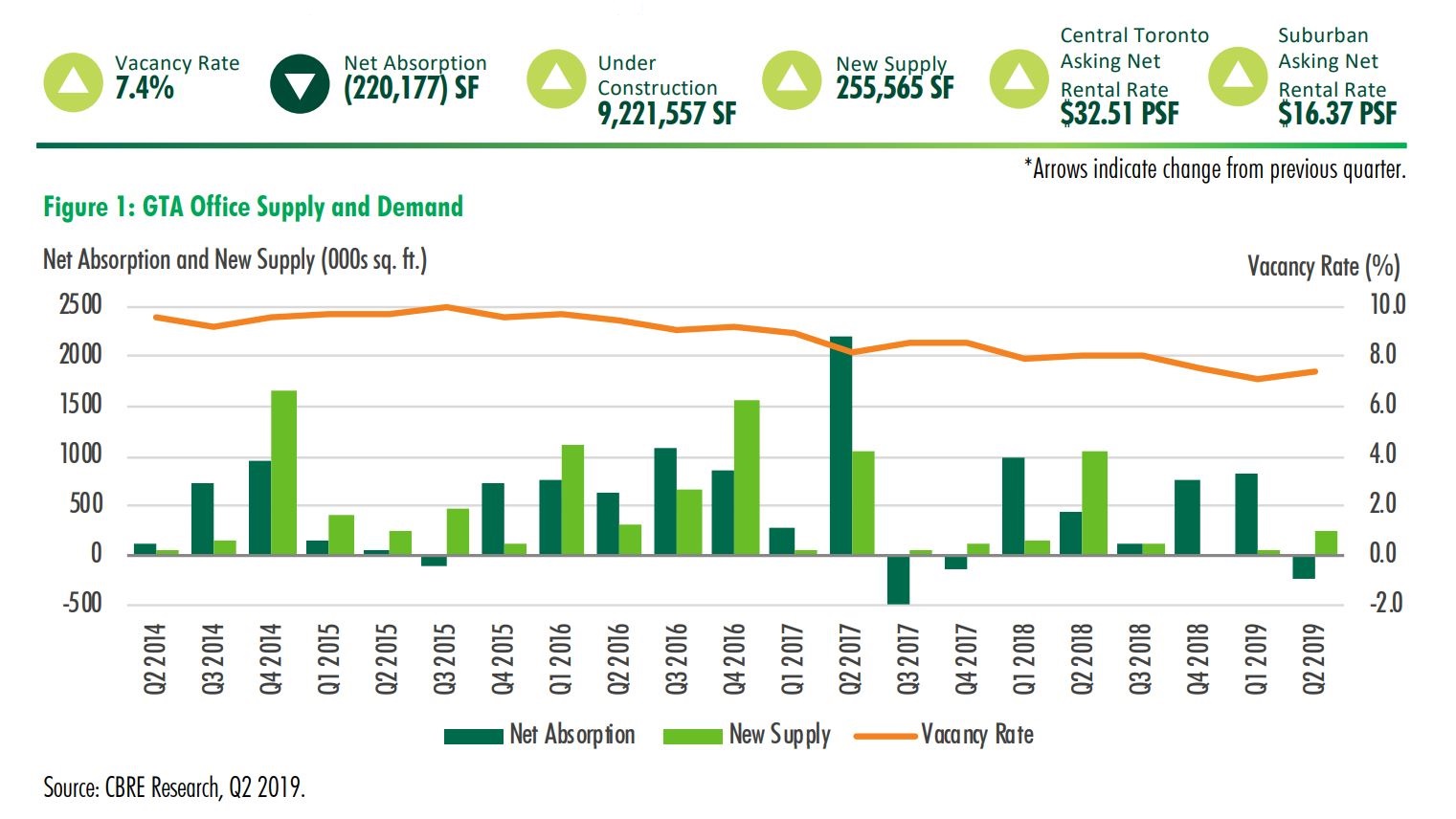

While the office market downtown is booming, the overall vacancy rate in the Greater Toronto Area actually increased by 30 bps in the same time span, reaching 7.4%. The differences between the Downtown Toronto and suburban markets were also evident in second quarter net absorption. The GTA-wide 220,177 ft² of negative net absorption can be attributed to the suburban markets' 534,340 ft² of negative net absorption, while the Downtown market saw a positive net absorption of 351,874 ft².

GTA-wide net rents appreciated slightly in the 2nd quarter, rising 0.16% from $19.05/ft² to $19.08/ft². This price growth was strongest in the Financial District, where overall net rents reached $39.24/ft². Class A net rents in the Financial Core submarket reached $40.05/ft², a record high marking a 3.6% increase quarter-over-quarter. Net rent prices decreased in suburban markets, echoing the trend of companies seeking a Downtown presence to attract the younger, urban workforce.

GTA Q2 2019 office market stats, image courtesy of CBRE

GTA Q2 2019 office market stats, image courtesy of CBRE

Let us know what you think using the comments section provided below.

* * *

UrbanToronto has a new way you can track projects through the planning process on a daily basis. Sign up for a free trial of our New Development Insider here.

5.7K

5.7K