Memph

Active Member

I had a look at the commuting flow tables available for the 2006 and 2016 census to see which communities were had net in-commuting vs net out-commuting.

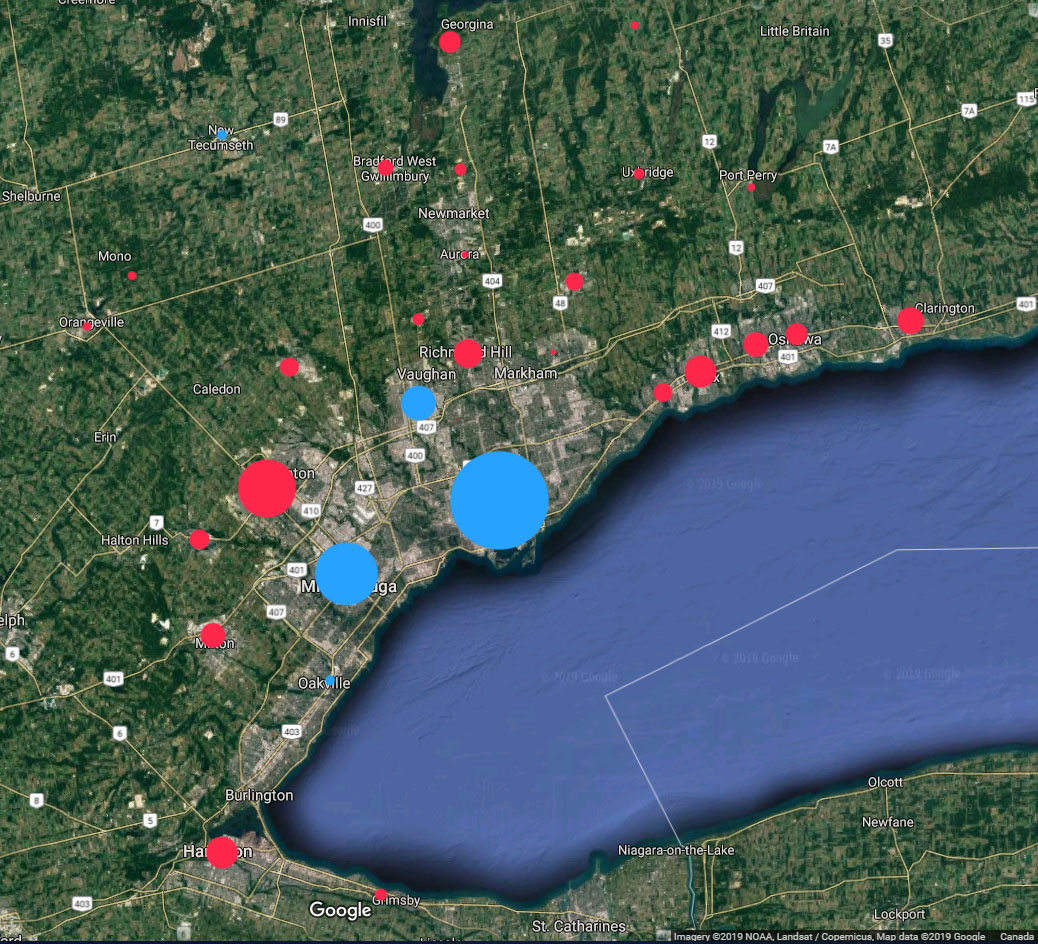

The image shows communities with net in-commuting in blue and net out-commuting in red, with the surface area of the circle being proportional to the quantity of net in/out-commuters.

So as expected, Toronto is a major job centre, but Mississauga and Vaughan are also major employment destinations relative to how big of a city they are. Brampton has the most net out-commuting at 83,875. With 0.65 jobs per worker, much of its population commutes to neighbouring communities for work. However, there are smaller communities that are more bedroom community-esque.

Workers per job

Georgina: 0.35

Mono: 0.39

Ajax: 0.50

Clarington: 0.51

Bradford-West Gwilimbury: 0.53

Whitchurch-Stouffville: 0.55

The image shows communities with net in-commuting in blue and net out-commuting in red, with the surface area of the circle being proportional to the quantity of net in/out-commuters.

So as expected, Toronto is a major job centre, but Mississauga and Vaughan are also major employment destinations relative to how big of a city they are. Brampton has the most net out-commuting at 83,875. With 0.65 jobs per worker, much of its population commutes to neighbouring communities for work. However, there are smaller communities that are more bedroom community-esque.

Workers per job

Georgina: 0.35

Mono: 0.39

Ajax: 0.50

Clarington: 0.51

Bradford-West Gwilimbury: 0.53

Whitchurch-Stouffville: 0.55