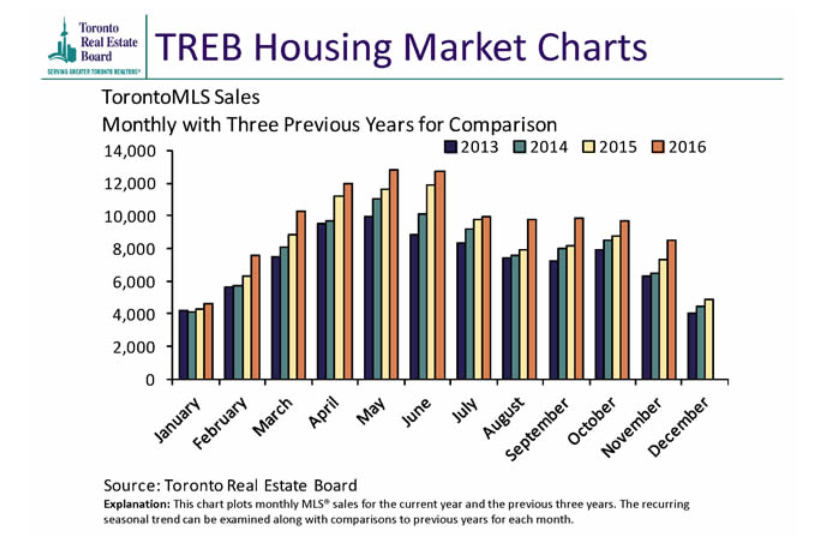

New figures released by the Toronto Real Estate Board (TREB) for November show continued strength in Toronto's resale housing market, accompanied by a dip in the commercial market compared with November 2015's figures. During the month of November, a total of 8,547 home sales were recorded through TREB's MLS® System, marking a 16.5% increase in sales over November of last year.

According to TREB President Larry Cerqua, "home buying activity remained strong across all market segments in November. However, many would-be home buyers continued to be frustrated by the lack of listings, as annual sales growth once again outstripped growth in new listings. Seller's market conditions translated into robust rates of price growth".

The price of new homes has also surged since one year ago, with the new average selling price of $776,684 up by 22.7% year-over-year. Condo and townhome apartment units were subject to the strongest annual sales rate ever recorded, factoring into the year-over-year increase in sales for all major housing typologies. A trend of rising home prices is being chalked up to a lack of housing inventory by TREB’s Director of Market Analysis Jason Mercer. The lack of inventory drives demand, which translates to inflating prices. "Recent policy initiatives seeking to address strong home price growth have focused on demand. Going forward, more emphasis needs to be placed on solutions to alleviate the lack of inventory for all home types, especially in the low-rise market segments,” said Mercer.

TREB housing market chart for November 2016, image courtesy of TREB

TREB housing market chart for November 2016, image courtesy of TREB

Contrasting the housing market figures, TREB's release of commercial market statistics shows that a combined 286,265 sq ft of industrial, commercial/retail, and office space leased through TREB’s MLS® System in November 2016. Though these figures represent a 33.6% decrease in activity over November 2015, the combined 48 industrial, commercial/retail and office property sales reported equal last year's figures.

Despite the same number of sales, the distribution of property types was different, with office properties representing a higher percentage of sales, and fewer industrial transactions recorded. The industrial market still accounted for around 60% of space leased in November, with average industrial lease rates at $6.09 per square foot net, an increase over November 2015's figures. When considering the combined industrial and commercial/retail submarkets, sales prices on a square foot basis increased year-over-year, while average office property sale prices decreased.

TREB's Cerqua commented “The most recent results for Gross Domestic Product in Canada presented some positive indicators for the economy and commercial real estate market. It was certainly welcome to see a strong uptick in exports reported, given that many businesses in the GTA are focused on the export of goods and services. If this trend continues, it is possible that some firms may look at further investment in real estate in anticipation of increased demand for the products they produce."

980

980