For many older Toronto homes, the high energy costs that come with aging windows and doors, outdated heating and electrical systems, and poor insulation, often make life increasingly expensive. However, while energy efficient retrofits usually bring long-term savings to home-owners, the upfront costs of these repairs can be prohibitively high. This leaves many homeowners in a difficult financial situation, with money-saving retrofit projects financially out of reach. To help residents save money and conserve resources, the City of Toronto recently launched the Home Energy Loan Program (HELP), a pilot project that provides loans for home energy efficiency improvements.

Historic rowhouses in Toronto's cabbagetown, image by Marcus Mitanis

Historic rowhouses in Toronto's cabbagetown, image by Marcus Mitanis

According to Marco Iacampo, HELP's Program Manager, "research found that the biggest barrier to homeowners taking on deep retrofits of their home was the high upfront cost of many of these projects. By offering accessible financing, we hope to help homeowners to reduce not only their energy consumption and greenhouse gas emissions, but also lower their monthly energy bills, while improving the housing stock in the city." For interested homeowners, the application process is relatively straightforward, beginning with a Pre-Application form and home energy assessment.

Following a certified home energy assessment, property owners of a detached, semi-detached, or row house can request funding in the form a low-interest loan worth up to 5% of the total property value. Once approved, the funds can go towards a variety of home energy improvements, including the installation of efficient heating / cooling, air sealing, window and door replacement, insulation upgrades, toilet replacement, as well as a number of other energy-efficient upgrades.

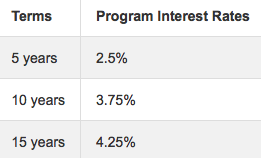

HELP's fixed interest rates, image courtesy of the City of Toronto

HELP's fixed interest rates, image courtesy of the City of Toronto

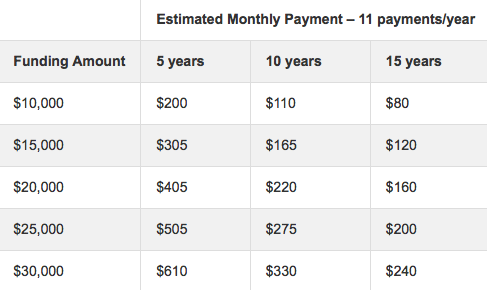

HELP offers flexible repayment terms combined with fixed interest rates, accommodating a range of budgets and repayment plans while maintaining predictable costs. The chart above illustrates the interest rates for repayment terms over 5, 10, and 15 years, while the table below estimates the monthly costs associated with a variety of loan and repayment structures. In addition, all loans can be repaid early at any time, without penalty.

The City's estimate of monthly payments (11 per year), image courtesy of the City of Toronto

The City's estimate of monthly payments (11 per year), image courtesy of the City of Toronto

The City's fixed, low-interest program provides an affordable solution to increasing energy costs, providing homeowners the capital they need to save money long-term. Decreasing energy use, the upgrades facilitated by HELP serve to foster environmental sustainability and ease the strain on the City's power grid, while providing direct energy savings to the home-owner.

Unlike typical bank loans, HELP funding is tied to the property as opposed to the owner, offering homeowners the flexibility of selling their home without carrying the balance of the loan. Attached to the property tax bill, the balance of the loan would be assumed by the new owner in the event that the property changes hands.

As Toronto's supply of single-dwelling homes ages, it becomes increasingly important to sustain the livability and environmental efficiency of these buildings. To homeowners, for whom the costs of retrofits can potentially be overwhelming, HELP is designed to provide the financing that makes these initiatives possible.

A link to the City of Toronto's HELP website can be found here.

1.2K

1.2K