UrbanToronto is pleased to welcome Mike Collins-Williams as a guest contributor. Mike is a Registered Professional Planner and is the Director of Policy at the Ontario Home Builders' Association (OHBA). This is the first in a series of articles he will be writing that will focus on urban development in the GTA.

The Greater Golden Horseshoe (GGH) is one of the fastest growing metropolitan areas in North America. While UrbanToronto generally focuses attention on specific high-rise projects, this column will examine broader planning issues and development patterns across the GGH. This large region is expected to grow from approximately 9.1 million people in 2011 to approximately 11.5 million by 2031. Over the past couple of decades growth patterns across this region and especially in the ‘inner ring’ GTA have undergone a fundamental shift from primarily single family suburban dwellings to more intensified urban dwelling types. This paradigm shift in terms of the types of communities that we live, work and play in has accelerated over the past few years and will continue to shift in a more urban direction in the future.

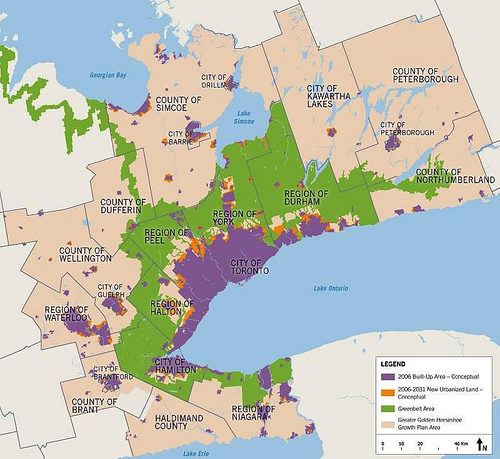

Greater Golden Horseshoe Growth Plan - 2031 Urbanized Land

Greater Golden Horseshoe Growth Plan - 2031 Urbanized Land

The high-rise market has been a source of considerable strength the last several years and despite the global economic turmoil we find ourselves in, 2011 set a new record high in condo sales: Urbanation reported 28,190 sales in 2011, exceeding the previous record of 22,654 in 2007. Sales volumes have been supported by variety of factors including: investment based on the strength of the Canadian financial system and real estate markets, continued high levels of immigration to the GTA, relative affordability due to historically low mortgage rates, and a highly competitive marketplace. Currently, the number of cranes in the Toronto skyline far exceeds any other North American city.

The multi-residential sector contrasts sharply with the broader housing market across Ontario. Despite mediocre overall provincial housing numbers, multi-unit housing starts reached their highest level since 1988, while other forms of housing (i.e. single family) are plodding along at near record lows. These fairly monumental shifts of consumer choices in terms of housing types have occurred partially due to declining affordability of single family homes, limited land supply, changing lifestyle choices favouring urban living and significant changes in provincial government policy regarding urban development.

Over the last decade the provincial government has brought about a number of major changes to policies shaping our urban region. Keep in mind that once policies change at the provincial level, they often take years to make their way into municipal land use policy and through the approvals process to actually impact development on the ground – we are really just starting to see the impact of policy decisions made years ago. A short list of some of the changes include:

- A new Provincial Policy Statement (PPS) in 2005 - the PPS provides direction on matters of provincial interest related to land use planning and development, and promotes the provincial “policy-led” planning system. A key change from the previous PPS was that municipal decisions must be “consistent” with the PPS rather than just “having regard for the PPS”.

- The City of Toronto Act gave the city some additional planning powers including allowing for design review and for a Local Appeals Body to oversee planning appeals of some decisions (the city has not as of yet set up a LAB).

- The Greenbelt Act and Greenbelt Plan protects 1.8 million acres of land. These essentially specify the large region of the province in which little to no development can occur and heavily restricts land-use in the outer GTA.

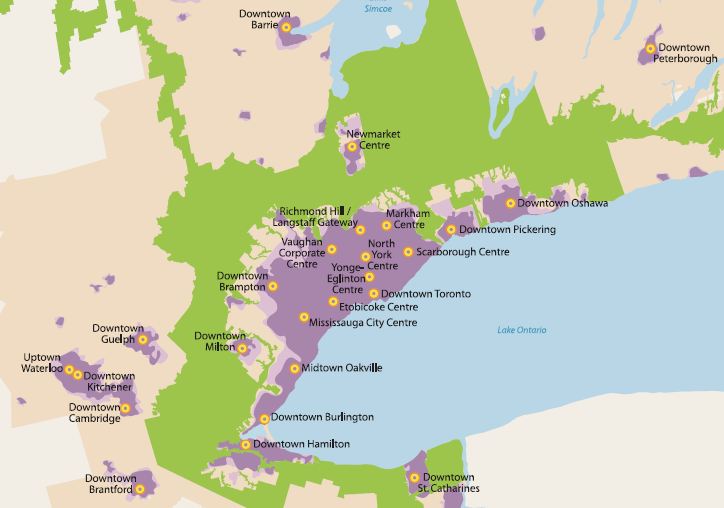

- The Places to Grow Act and the Growth Plan for the Greater Golden Horseshoe. The Growth Plan is a fundamental shift for the province in terms of regional planning. The Growth Plan mandates density targets for greenfield development, assigns population and employment targets for regional levels of government and also sets intensification targets. The Plan also creates 25 “Urban Growth Centres” (UGCs) where higher levels of intensification are planned at 150, 200 & 400 persons and jobs combined per hectare depending on the UGC. The planning process to implement the Growth Plan on the ground at the local level is currently underway as all regional and local municipal official plans across the Greater Golden Horseshoe are required to complete an extensive, and in some cases controversial, conformity process with the Growth Plan.

- Revisions to the Planning Act. A few years ago some aspects of the approvals process were alterred, which reaffirmed the critical role of the OMB in the land use planning process as an independent adjudicative body that hears appeals on a variety of municipal and land use matters. This role provides tension in the planning system and requires local decisions to conform to provincial policies – a role that has become even more important and controversial as provincial priorities shift towards intensification.

- Metrolinx – most UT readers will be fairly familiar with the creation of Metrolinx, which was followed by a merger with GO Transit in 2009. The Big Move Regional Transportation Plan will assist to facilitate achieving many of the targets set out in the Growth Plan. The elephant in the room is of course funding. Metrolinx plans to begin consultations on a long-term investment plan in 2013.

Greater Golden Horseshoe Growth Plan - Urban Growth Centres

Greater Golden Horseshoe Growth Plan - Urban Growth Centres

So how are all these changes impacting urban development patterns on the ground? Growth Plan conformity has been a very slow process (target year or completion was originally 2009), so the full results will take years, but the various Regional Official Plan Amendments (ROPAs) are now either approved, at the OMB, or entering into advanced negotiations. Greenfield density targets of 50 persons/jobs per hectare and minimum intensification targets (40%) in the regions are key features of the Growth Plan. However it should be noted that due to significant land supply shortages these targets are already essentially being reached a few years early for the ‘inner ring’ municipalities.

A number of years ago and still today in many smaller municipalities outside the GTA, these intensification and density targets were considered very aggressive. These levels of intensification far exceed the GTA experience in the 1980s & 1990s. Despite these ongoing changes, there continues to be a massive misconception that it is "business as usual" in the 905.

Jurisdiction • 2011 Population • 2031 Population

City of Hamilton • 540,000 • 660,000

Region of Halton • 520,000 • 780,000

Region of Peel • 1,320,000 • 1,640,000

Region of York • 1,060,000 • 1,500,000

Region of Durham • 660,000 • 960,000

City of Toronto • 2,760,000 • 3,080,000

GTAH Total • 6,860,000 • 8,620,000

GGH Total • 9,090,000 • 11,500,000

Source: Growth Plan for the Greater Golden Horseshoe: Schedule 3

*Forecasts by Hemson Consulting Ltd., Jan 2005

**Ontario Growth Secretariat is scheduled to update population #s in 2012

The Greenbelt and Growth Plan work in tandem with the greenbelt currently being buffered by a long-term strategic urban reserve often referred to as the ‘whitebelt’. The whitebelt is essentially the 58,696 hectares of land between the current urban growth boundaries and the greenbelt. As urban areas grow in the future, new lands will be required to be designated for growth during municipal Official Plan reviews. The growth plan outlines a series of tests and criteria for future lands to be re-designated. A recent report by the Friends of the Greenbelt Foundation suggests that if the Growth Plan is successful, that the whitebelt should suffice to accommodate urban development for several generations. Here are some of the key numbers:

- There are 58,696 ha of land available beyond currently designated lands for urban expansion in the whitebelt

- The proposed municipal official plan updates to bring them into conformity with the Growth Plan include requests for an additional 10,115 hectares to accommodate greenfield development up to 2031 (5,196 ha residential / 4,919 ha employment)

- These requests represent 17.2% of the whitebelt; if approved, these requests would leave 82.8% of the whitebelt intact until at least 2031.

Land consumption is slowing significantly due to intensification and much higher greenfield densities. Our suburbs, while still being 'suburban' or considered 'sprawl' by some are being planned and developed very differently than in the past not only in terms of density and mixed uses, but also in terms of infrastructure, servicing and protecting natural heritage features with a strong focus on watershed based planning. Additional policy and fiscal tools to support intensification would accelerate the process that has already started, but significant progress to improve urban environmental sustainability and promote complete communities has been made to date.

Furthermore there is greater attention being paid today to individual building envelopes. Starting on January 1, 2012 the Ontario Building Code which already had high standards far exceeding the Canadian Model National Code, will feature energy targets which is a first in North America outside of California. The proliferation of green energy programs such as R-2000, GreenHouse, EnergyStar & LEED is also changing the way housing is built in the suburbs.

The Five Year Growth Plan Update released this summer, this includes growth modeling comparing two future scenarios: one that assumes the Growth Plan will be fully implemented, and one that does not take the Growth Plan into account. It suggests that the Growth Plan could help to conserve as much as 800 square kilometers of agricultural and rural land by 2031 (14% increase in urbanized land vs 39% increase). Research into existing development patterns over the last decade across the entire Greater Golden Horseshoe (Peterborough to Collingwood to Kitchener-Waterloo all the way down to Niagara) indicate:

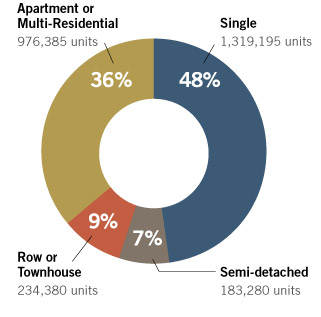

Total Housing Stock in Greater Golden Horseshoe CMAs - 2006

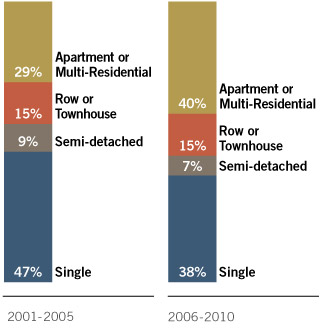

Housing Construction by Unit Type - GTA (Inner Ring GGH)

The shift in the ‘inner ring’ GTA specific housing starts is even more pronounced as greenfield land availability is at a critically low volume due in part to official plans being tied up in conformity issues as well as ongoing market shifts. The 2001-2006 numbers in the graphs above were already an improvement over the 1990s, and due to some serious land supply issues emerging in a number of areas in the GTAH the first half of the current decade is going to undergo a further major shift towards even more intensified patterns of growth.

The ongoing evolution of land-use and development in the GTA brings about challenges and opportunities in the future. Former Burlington Mayor and Chair of Metrolinx, Rob MacIsaac, once said “the only thing people hate more than urban sprawl is intensification” – this is a real challenge as the region grows by about 100,000 people every year with more and more residents moving into existing established communities rather than greenfields. Planning for growth and infrastructure becomes more complex due to competing interests within established neighbourhoods and political wrangling over transit infrastructure that is necessary for the long-term success of medium-to-high density communities.

In the future Toronto will continue the shift of growing up rather than out. Urban Growth Centres in the 905 such as MCC, VMC and Downtown Markham will be major focuses of growth and infrastructure investment as they mature into urban communities. The transit file continues to be a major source of frustration, but investment levels have increased and are running at record highs in real terms and as a % of GDP are back at the levels in the 50s & 60s – the problem is we’ve gotten so far behind due to decades of under-investment. We live in an exciting time in Toronto’s history as the growing region is truly beginning to assert itself on the global stage in a wide range of economic, and social measures. The stars have really aligned for Toronto and with intelligent public and private sector decision making in the years ahead our home city really has unlimited potential to shine.—Mike Collins-Williams, RPP, MCIP

7.3K

7.3K