late 80's pricing

Does anyone here have hard stats on what prices were psf in the late 80s boom? I recently read somewhere that prices have only just reached where they used to be at that peak, just before the big crash of 89/90.....

For anyone looking for a good resale value, look into 736 Spadina, The Mosaic. Excellent Annex location and the flippers have just started to unload their units as final closing was one month ago.

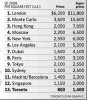

Here's a chart off Remax site regarding Average Selling Price from 1980-2007.

It states that the average price reported for 2007 was

38 percent higher than the previous peak in 1989.

http://www.randi-emmott.com/market.htm#avg price 80-99

TREB - residential average price from 1990 to 2008.

http://www.torontorealestatereports.com/marketwatch.htm

Bear in mind that there are more condos now, which are lower in price than single-family residences, hence, the average price is pulled down lower. This implies that average GTA prices are probably higher than what the average price indicates.

=======================================================================

Regarding late 80's pricing, I can offer an anedoctal example.

My parents bought their house in the east end of Toronto for $250K in 1990.

Last month, an identical house on the street sold for $300K after sitting on the market for 3months. It was originally listed at $320K.

=======================================================================

I've seen the layouts at The Mosaic and they are pretty bad.

You have LR/DR which are less than 10 ft wide ... that's pretty cramped.

I would say 10 ft width should be the

minimum to allow for adequate traffic flow and various furniture placements.